Introduction

Entrepreneurship is crucial for national economic growth, driving innovation and employment (Acs, 2010; Baumol, 1996; Wong et al., 2005). It fosters technological development, economic progress, and social mobility (Lazar et al., 2019). The evolution of firms and industries through entrepreneurship is tied to innovation, which subsequently fuels economic growth (Reynolds et al., 2005). At both micro and macro levels, entrepreneurship impacts individuals, firms, and entire countries or regions.

Given its significance, entrepreneurship should be central to public policies. These policies should incentivize entrepreneurial activities by creating frameworks that stimulate entrepreneurship and encourage a cycle of innovation and job creation. Policies also play a critical role in fostering environments where entrepreneurs can find role models and succeed (Audretsch, 2004). However, Shane, 2009suggests that public policies often encourage new businesses that lack growth potential, leading to high failure rates. Instead, policies should focus on fostering high-growth, high-quality businesses that contribute significantly to economic growth and job creation.

Research also highlights the importance of entrepreneurial teams, which are more likely to create successful ventures compared to individual entrepreneurs. Studies show that firms started by teams experience higher growth, more innovation, and generate more jobs (Chowdhury, 2005; Harper, 2008; Shane, 2009). However, not all entrepreneurs form teams, as some prefer self-employment and are content with small-scale ventures (Lau & Busenitz, 2001; Reynolds, 1997).

The question arises: do entrepreneurial teams outperform solo entrepreneurs in terms of innovation, internationalization, and job creation? To answer this, we compare firms created by individuals versus teams. Both individual and team entrepreneurship are influenced by micro-level factors (such as personal traits and team dynamics) and macro-level factors (like institutional frameworks and public policies) (Autio et al., 2013; Bosma, 2012; Danis et al., 2011).

A key macro-level factor is economic freedom, defined as the protection of individual rights and freedom from excessive government intervention (The Heritage Foundation, 2020; Gwartney & Lawson, 2003). The study aims to examine how entrepreneurial teams, and individual entrepreneurs differ in the types of firms they create and how economic freedom shapes these outcomes.

The study makes two main contributions: it expands the literature on entrepreneurial teams by incorporating economic freedom as a moderating factor and empirically investigates how teams and individual entrepreneurs perform in terms of innovation, internationalization, and job creation across 65 countries. This analysis offers insights for policymakers seeking to foster high-performing ventures in diverse contexts.

Theoretical framework and hypothesis

Entrepreneurs possess unique individual-specific resources that enable them to recognize new opportunities and build the necessary resources for their ventures (Alvarez & Busenitz, 2001). Resource-based theory emphasizes the importance of resource heterogeneity across firms, suggesting that differences in resources and capabilities significantly affect the type of firms created, particularly in terms of innovation, internationalization, and employment generation (Barney, 2000; Conner & Prahalad, 1996). Entrepreneurship, viewed as a complex component within this framework, hinges on the availability and strategic use of diverse resources (Alvarez & Busenitz, 2001). Furthermore, institutional theory posits that individual entrepreneurial behaviour is influenced by both formal and informal institutions, with economic freedom being a key formal institution shaping entrepreneurial decisions (Busenitz & Lau, 1996; De Clercq et al., 2013). This paper examines the interplay between individual entrepreneurship, entrepreneurial teams, and institutional contexts, specifically how economic freedom moderates the relationship between entrepreneurial teams or solo entrepreneurs and the firms they create. It proposes that entrepreneurial teams, with their greater access to resources, networks, and diverse knowledge, are more likely to foster innovative, internationalized, and high-employment-growth firms compared to solo entrepreneurs. Moreover, in contexts of high economic freedom, these advantages are further amplified, providing entrepreneurial teams with the freedom to innovate, internationalize, and hire more employees, thus fostering greater firm growth and development. The paper concludes by offering hypotheses on the moderating role of economic freedom in these relationships.

Entrepreneurs have individual-specific resources that facilitate the new opportunities recognition and the constructing of resources for the ventures (Alvarez & Busenitz, 2001). By focusing of resources, from opportunity recognition to the capacity to organise these resources into the firms and the creation of different outputs through the firm that are superior to the market.

Early work on resource-based theory recognize that entrepreneurship is a complex part of the resource-based framework (Conner, 1991; Conner & Prahalad, 1996).

The most basic condition of resource-based theory is resource heterogeneity and it accepts differences of resources and capabilities across firms (Barney, 1996, 2000). Heterogeneous resources are also a basic condition of entrepreneurship (Alvarez & Busenitz, 2001). Built on resource-based theory, we think that individual entrepreneurs and entrepreneurial teams have crucial differences in the resources of each group have. Moreover, those differences influence on the types of firms that individual entrepreneurs and entrepreneurial teams created in terms of innovation, internationalisation, and employment generation.

According to Institutional Theory, individual factors in entrepreneurship are influenced by formal and informal institutions (Busenitz & Lau, 1996; De Clercq et al., 2013; Gupta et al., 2004; Urbano & Alvarez, 2014; Veciana & Urbano, 2008). The relationship between start a business by individual entrepreneur or by entrepreneurial teams with the type of firms created during the process is shaped by formal institutions. Amongst formal institutions, economic freedom is one of the most relevant factors that affect the new business formation. Economic freedom is at its fundamental regarding individual autonomy, with the freedom of choice in obtaining and using economic goods and resources. However, the objective of economic freedom is not simply the absence of government coercion or constraint, but instead the creation and conservation of a mutual sense of liberty for all individuals. It is necessary for the citizens of a nation to protect themselves and promote the peaceful evolution of the society some government actions.

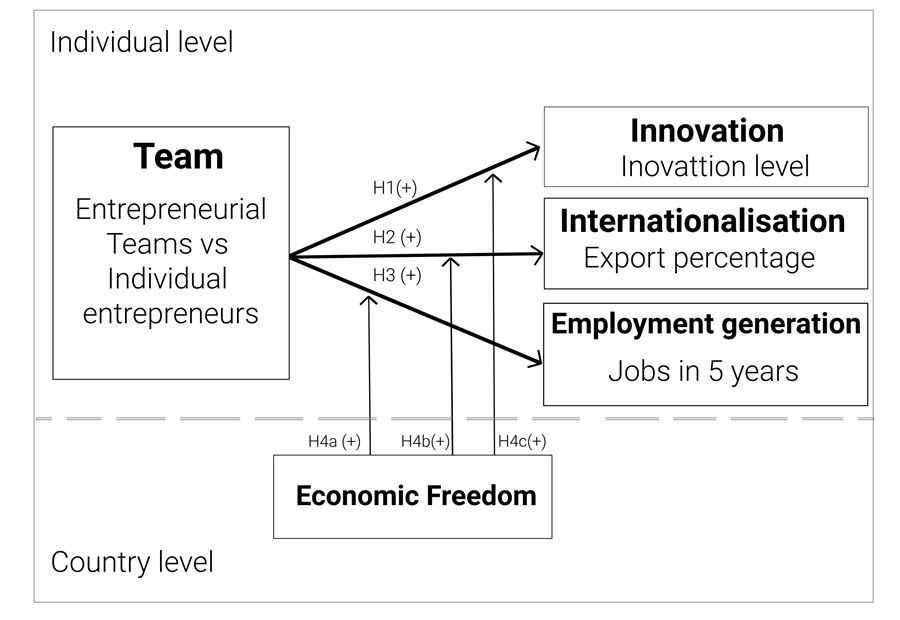

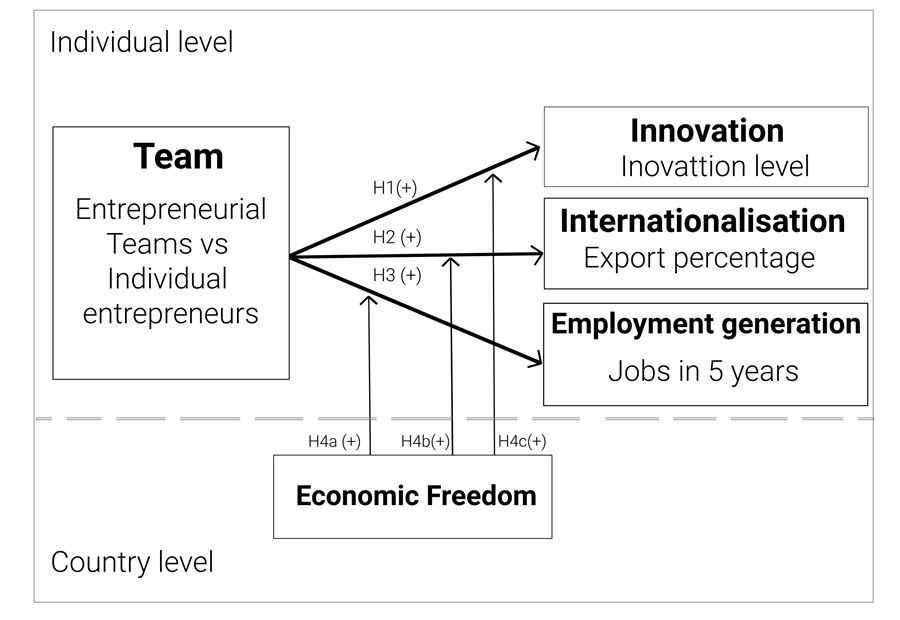

Nevertheless, this intricate interplay between individual and institutional-level factors has barely been examined. In response, we analyse the relationship between start a business by individual entrepreneur or by entrepreneurial teams with the type of firms created during the process. We also examine the national formal context (Economic Freedom) as the moderating factor for this relationship, which we develop in detail in the next chapter, and summarise in our conceptual framework as illustrated in Figure 1.

Figure 1

Theoretical model

Figure 1

Theoretical model

Source: Own elaboration.

Entrepreneurial Teams vs Solo Entrepreneurs

Entrepreneurial teams have a greater capacity to manage growth, greater ability to discover and exploit new opportunities and have larger social networks and access to more resources (Aldrich & Kim, 2007; Chandler et al., 2005; Klotz et al., 2014; Penrose, 1995; Ruef, 2010; Wasserman, 2012), fundamental factors to develop a venture. When analysing the types of firms created by entrepreneurs, we focus on innovation, internationalization, and employment generation.

Innovation

Innovation is the process that involves the commercialisation of ideas, implementation and, the modification of existing products, systems and resources (Mueller & Thomas, 2001). Product market innovations, innovate technological processes and new organisational design are forms of innovate entrepreneurship (Fuentelsaz et al., 2018). Entrepreneurial teams result in more innovative companies than individual entrepreneurs as differences between team members provide a stimulus for innovation because ideas come from a variety of contexts, with diverse perspectives and a variety of decision-making criteria. This cognitive diversity in terms of skills, knowledge, tools, and perspectives allow make more innovative decisions. Having knowledge in different areas allows know the market, the needs of customers and how they are being or not being resolved. In this way the knowledge cluster allows find niches of the market without satisfying and develop innovative products or services. In addition, such differences are important in complex environments, where firms face conflict. For example, negotiating forms of intellectual property such as patents or licenses (Agarwal et al., 2007; Dimov & Shepherd, 2005; Jin et al., 2017; Vyakarnam & Handelberg, 2005).

An entrepreneurial team has higher levels of human capital compared to an individual entrepreneur because human capital is not only the sum of members' human capital, but also the result of the synergy that occurs between members that increases that capital. Synergy processes are characterized by flexibility and open communication that encourages members to share and build on the ideas and perspectives of others. These processes of synergy between team members help to face non-routine problems and thus achieve, higher quality results, more creative and innovative (Chowdhury, 2005; Ensley et al., 2003; Ensley & Hmieleski, 2005; Ensley & Pearce, 2001; Jin et al., 2017).

Team members find support that strengthens their characteristics (confidence in their own skills, optimism, greater creativity, greater curiosity and greater questioning of the current market situation and decision to experiment). These features provide entrepreneurs with the courage to innovate. Team members perceive their team as value and choose more challenging goals where innovation is required to achieve them. Trust among team members can increase the use of knowledge and information, increasing innovative capacity (Dimov & Shepherd, 2005; Ensley et al., 2000; Lechler, 2001).

Entrepreneurial teams can establish more powerful networks compared to individual entrepreneurs. Network access contributes to critical knowledge to create innovative entrepreneurial activity. The innovative capacity of organizations depends on the relationships between people in networks. Networks provide important sources of information and knowledge about the state of the external environment and the firm. External networks are vital for entrepreneurs to seek opportunities, test ideas and gain resources to increase innovation. Internal networks allow team members to have more opportunities to share resources, information, ideas, and increase knowledge. Internal networks are an important resource for teams because members can work together more effectively and efficiently when they know and trust each other and the way to increase innovation in the firm (Chen, 2007; Chen & Wang, 2008; Lechler, 2001).

Entrepreneurial teams get more funding than individual entrepreneurs because they generally develop higher-growth and expected-earning projects (Busenitz et al., 2005; Klotz et al., 2014; Macmillan et al., 1986; Nofsinger & Wang, 2011).

In relation to the previous argument, we propose the hypothesis 1.

Hypothesis 1. Entrepreneurial teams create more innovative firms when compared to individual entrepreneurs.

Internationalisation

International new ventures are defined as “a business organisation that, from inception, seeks to derive significant competitive advantage from the use of resources and the sale of outputs in multiple countries” (Bloodgood et al., 1996).

Entrepreneurial teams have greater resources in terms of time, energy, money, and experience, which benefit the development of complex tasks in complex environments and uncertainty, such as those presented by a company when want to internationalize. In this process there are several sources of uncertainty regarding products, institutional factors, organizational structures, access to resources and consumer needs. The resources that teams have the most in relation to individual entrepreneurs have a crucial influence on the internationalization of firms since lack of resources is one of the most important obstacles (Autio et al., 2011; Bloodgood et al., 1996; Brush et al., 2001, 2002; Tang, 2011).

Entrepreneurial teams are more likely to have experience and knowledge in different areas than an individual entrepreneur. To internationalize a firm, the international experience of a team member is critical. The international operations of firms are gradually increased by gaining knowledge and experience at the international level. Capabilities, knowledge of processes and routines to carry out internationalization facilitate internationalization of the firm because the dynamics of such markets are known and allow to find opportunities internationally (Autio et al., 2011).

Entrepreneurial teams have higher levels of knowledge because the learning process is not only individual learning, but is a collective learning that derives from teamwork, cooperation and integration among team members, generating new routines based also on the knowledge of past experience routines. So, among all they can generate more efficient and effective routines required in the internationalization process (Casillas et al., 2009; Moreno & Casillas, 2007).

Entrepreneurial teams have greater social capital than individual entrepreneurs. Increasing social capital for new firms allows better access to international resources and opportunities and means of countering barriers to being new to the market being incurred. The diversity of knowledge and information of entrepreneurial teams can reduce the uncertainty associated with internationalization.

Entrepreneurial teams have greater access to networks than individual entrepreneurs. External social capital – external networks (social and business) positively impact knowledge of the foreign market and can lead to the international growth of new firms. Networks with consumers, producers, institutions, etc. generate opportunities and can provide external resources for the development of the firm internationally. Internal networks enable knowledge generation. The dynamics of entrepreneurial teams versus individual entrepreneurs allow to acquire knowledge with other areas of the firm, since the team is more accustomed to working under cooperation and integration. This dynamic allows the identification of internationalization opportunities (Arenius & Clercq, 2005; Coviello, 2006; Jones et al., 2011; Kwon & Arenius, 2010).

Entrepreneurial teams get more funding than individual entrepreneurs to grow in uncertain environments, so they will have greater incentives to internationalize (Arenius & Autio, 2006).

In relation to the previous argument, we propose the hypothesis 2.

Hypothesis 2. Entrepreneurial teams create more internationalised firms when compared to individual entrepreneurs.

Employment generation

Entrepreneurial teams are used to working with others through integration and cooperation strategies. They passionately believe they can share knowledge and experience and learn from new employees. Individual entrepreneurs are going to delay hiring employees because they are used working alone and want to maintain their independence (Jin et al., 2017).

Entrepreneurial teams more easily find opportunities to develop more complex projects with greater opportunities for growth. To address this growth and efficiently and effectively develop projects, they need to hire employees. Individual entrepreneurs generally develop less complex projects that don't require as many resources and generally develop them on their own (Kolvereid, 1992; Wiklund & Shepherd, 2003).

Team members find support that strengthens their entrepreneurial characteristics (confidence in their own skills, optimism or sense of control, greater creativity, greater curiosity and greater questioning of the current market situation and decision to experiment). These characteristics, the support and confidence they develop among the team provide entrepreneurs with the courage to grow. That is, entrepreneurial teams have higher growth aspirations and greater ability to manage growth than individual entrepreneurs, decide to grow and, require hiring employees to develop growth processes (Ensley & Pearce, 2001; Hmieleski & Ensley, 2007).

Entrepreneurial teams have larger (external) social networks which would eventually allow them to meet valuable people who want to integrate firms as employees. Strengthening the human and social capital of firms helps their growth. Hiring employees who strengthen the human and social capital of firms is a key factor in growing effectively and efficiently (Hermans et al., 2015).

Entrepreneurial teams get more funding than individual entrepreneurs. Such resources can be used to grow, including job recruitment (Cassar, 2004, 2006, 2010; Choi et al., 2008; Shepherd et al., 2009).

In relation to the previous argument, we propose the hypothesis 3.

Hypothesis 3: Entrepreneurial teams create more high employment growth firms when compared to individual entrepreneurs.

The contingent role of economic freedom

We established in hypotheses 1 to 3 the relationships between being an individual entrepreneur or entrepreneurial teams and the type of firms that each group created. However, such entrepreneurs can live in a context with or without economic freedom. In this section, we analyse the country level context, specifically how an economic freedom context moderates those individual level relationships.

In hypotheses 1 we explain that entrepreneurial teams result in more innovative companies than individual entrepreneurs since factors such as differences between team members, the synergy that is created between the entrepreneurial team, which promotes support among members and wider networks allows them to find and develop projects that face dynamic environments that require solutions through innovative products and services.

However, entrepreneurial teams in countries with high levels of economic freedom have greater incentives to innovate as they are certain that their rights are protected when they develop their products or services with innovation and will receive the benefits of innovating. Property rights protect firms in situation that could be from conflicts such as negotiating patents or licenses or other forms of intellectual property. In addition, entrepreneurial teams that create their projects in environments with high levels of economic freedom have greater incentives to innovate because these countries have a mature economic system that allows financing projects with higher levels of uncertainty, such as developing innovative firms.

In hypothesis 2, we proposed that entrepreneurial teams create firms that want to be more internationalized compared to the firms that individual entrepreneurs create because teams have greater resources in terms of time, energy, money and experience, which benefit the development of complex tasks in complex and uncertain environments, such as those presented by a company when it wants to internationalise. In addition, entrepreneurial teams have higher levels of knowledge because the learning process is not only individual learning, but is a collective learning that derives from teamwork, cooperation and integration between team members, generating new routines based also on knowledge of past experience routines. So, among all they can generate more efficient and effective routines required in the internationalization process and the teams have greater access to networks that individual entrepreneurs. External social capital – external networks (social and business) positively impacts knowledge of the foreign market and can lead to the international growth of new firms.

However, we have explained that individuals are highly influenced by contexts of economic freedom. In this way, entrepreneurial teams will have a greater incentive to internationalise their firms because they have freedom of commerce that allows them to interact freely with buyers and sellers in the international market. In addition, freedom of commerce allows free exchange of goods and services, expanding the ability of teams to market and find market opportunities and niches. This exchange can also be done with a stable exchange rate and market-determined prices.

Finally, in hypothesis 3 we argue that entrepreneurial teams create more firms with employment generation since they are used to working with other people through integration and cooperation strategies. They believe they can share knowledge and experience and learn from new employees. In addition, as entrepreneurial teams find and develop more complex projects, they need to hire employees who complete their human capital to reach project demands.

However, in contexts of economic freedom, entrepreneurial teams have greater incentives to create firms that hire employees because it allows them to freely hire workers with the possibility of negotiating working conditions. In this way, in countries with economic freedom, entrepreneurial teams that want to hire workers can do so by defining the conditions for growing firms, thus increasing job recruitment. In addition, the freedom to invest provides maximum entrepreneurial opportunities to expand job creation. Entrepreneurial teams have greater adaptability to growth and with freedom of investment have greater incentives to create jobs compared to individual entrepreneurs.

We predict a positive moderating effect of economic freedom towards the creation of more innovative firms, which are more internationalized and generate more jobs. We propose a set of following hypotheses:

-

Hypothesis 4a. The

positive relationship between creating an innovate firm by entrepreneurial

teams is positively moderated by economic freedom.

-

Hypothesis 4b. The positive relationship between

creating a firm to be internationalised by entrepreneurial teams is positively

moderated by economic freedom.

-

Hypothesis 4c. The positive relationship between

creating a high employment growth firm by entrepreneurial teams is positively

moderated by economic freedom.

Methodology

The sample

First, we obtained individual level data from the Adult Population Survey (APS) conducted by the Global Entrepreneurship Monitor (GEM), a research project initiated in 1998, focused on the creation of data about new business activity, that provides relevant harmonised data on an annual basis. The project evaluates how entrepreneurship contributes to the growth of national economies and provides data points at a national and individual levels. It reflects a wide range of factors associated with national variations in entrepreneurial activity and its characteristics (Reynolds et al., 2005). The project defined variables related to the social, cultural, and political context represented by each country, the general national conditions, and measures of national economic growth. GEM data is especially valuable for our analysis as it provides information regarding socio-economic characteristics of entrepreneurs, including many countries and a wide time horizon.

From the three types of entrepreneurs defined by GEM, we selected a sample of entrepreneurs that are (1) currently starting a new business or (2) the owner and managers of a young firm (less than 3.5 years old). This selection was made as it is at this early stage of the venture when entrepreneurs decide to form entrepreneurial teams, consequently determining their venture’s development path. Our sample includes 65 countries as shown in Table 1, with different economic freedom levels, and more than 18,000 observations of entrepreneurs. We use data covering a three-year period (2014-2016).

Table 1

Countries

Source: Own elaboration.

Second, to access a country formal institutions with respect to its economic freedom, we used Economic Freedom Index (The Heritage Foundation, 2020).

The Index of Economic Freedom takes a comprehensive view of economic freedom in 12 aspects. The 12 aspects of economic freedom measured in the Index are grouped into four broad categories that each one includes three aspects:

-

Rule

of law: property

rights, judicial effectiveness and, government integrity. Property rights refer

to protect workers and investors with private rights and effective rule of law.

Secure property rights give individuals the trust to

carry out entrepreneurial activities, save their income and make long-term

plans. Judicial effectiveness refers to legal frameworks that protect

the individuals in a country against violation of the law for others, including

by governments and powerful parties. Finally, the main factor in government

integrity is the absence of corruption. Systemic corruption of government

institutions by practices as bribery, nepotism, cronyism, patronage,

embezzlement, and graft restrict an individual´s economic freedom.

-

Government

size: tax

burden, government spending and, fiscal health. Governments

impose fiscal burdens on economic activity through taxation and borrowing.

Governments than let individuals and businesses to retain and manage a larger

share of their income and wealth for their own benefit and use, maximise

economic freedom. Government spending comes in many forms, for instance, to

provide infrastructure, fund research, or improve human capital. Moreover,

government spends on public goods. These examples give benefits to society;

however, they are eventually financed by higher taxation and entails an

opportunity cost. Finally, financial management of resources is a key indicator

of fiscal health. A government´s budget is one of the clearest indicators of

the extent to which it represents the principle of limited government and the

government´s commitment (or lack of), which is essential for dynamic long-term

expansion and key factor for the advancement of economic freedom.

-

Regulatory

efficiency:

business freedom, labour freedom and, monetary freedom. Business freedom is the ability by an individual to stablish and run a business

without intervention from the state and is one of the most fundamental

indicators of economic freedom. Labour freedom refers to the individual´s

ability to find employment opportunities and work. In the same way, businesses´

ability to contract freely for labour and terminate unnecessary workers is

essential to developing productivity and forward economic growth. Finally, A

stable currency and marked-determined prices are required for monetary freedom.

-

Market

openness: trade

freedom, investment freedom and, financial freedom. Trade freedom represents individuals´ ability to interact freely as buyers or sellers in the

international marketplace and can be influenced by restrictions from

governments. Investment freedom refers to a context characterised by

transparency and equity, supporting all types of firms. Finally, financial

freedom refers to system that guarantees the availability of diversified

savings, credit, payment and investment services to individuals and businesses.

To conclude, economic freedom is much more than a business environment which favours entrepreneurial activity. It influences on different aspects of human development, economic freedom empowers people, improving the overall quality of life.

Variables

Dependent Variables. We have four (4) dependent variables:

-

Innovation (Innovation level: 1 variable):

Innovation

level. We created a variable of innovation with the

sum of the three items that measure this issue in GEM: novelty for consumers,

level of competition, novelty of technology. Higher values are equals to an

innovative higher-level business.

-

Internationalisation: (Export level: 2 variables):

Export percentage: We created a four-level categorical variable that takes the values of: zero (0) if the firm does not export, one (1) if the firm exports at least 25% of its sales, two (2) if the firm exports between 25% and 75% of its sales and, three (3) if the firm exports more than 75% of its sales.

Export: We created a binary variable that takes the value of one (1) if the firm exports at least 25% and takes the value of zero (0) if the firm does not export.

-

Employment generation: (Employment level: 1 variable):

Jobs in 5

years: In GEM, it is a continuous variable that represents

the number of jobs that firms expected to have in the 5 years following the

survey.

Independent variables. Our independent variable is Team. It is a dichotomic variable that takes the variable of one (1) if entrepreneurs create a team, takes value of zero (0) if entrepreneurs go alone. For the country level environment, we used Economic Freedom. It is an index that has a range from the value of one (1) if the country has the highest level of economic freedom and zero (0) otherwise. Every country has a corresponding number according of the level of economic freedom.

Control Variables

We have included several control variables, at both the individual

and country levels, to ensure that the results were not unjustifiably

influenced by such factors. In each model, we controlled for characteristics of

the individual (gender, age, educational level, income level, entrepreneurial

motivation, knowing an entrepreneur, having skills to be an entrepreneur and fear

of fail) and, the sector where the project is developed. Data for all

individual-level control variables come from the GEM project. We control by

macro-variables (GDP per capita and GDP growth). Data for these variables was

obtained from the World Bank’s World Development Indicators database.

Data analysis and model

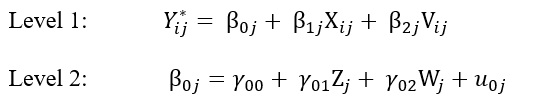

Our objective with this paper is to analyse the type of firms that individual entrepreneurs and entrepreneurial teams created in terms of innovation, internationalisation, and employment generation who decided to start a project alone or entrepreneurs who decided to start a project by team on growth aspirations in terms of employment generation. We aimed to estimate the influence of the entrepreneur at the individual level on the likelihood of creating a business, considering the contingent role of the Economic Freedom context at the country level as a moderator. Multilevel model analysis is appropriate for fitting data collected at different levels and estimating cross-level moderations (Luke, 2004). We use a multi-level regression analysis, differentiating the analysis among our different kinds of dependent variables (mixed and logit). These models are appropriate for fitting data collected at different levels, meaning a function of variables at more than one level can predict a dependent variable (Luke, 2004 cited by Gonzalez-Pernia et al., 2015). In this study, individuals (level 1) are nested within countries (level 2), which is represented by the following equations:

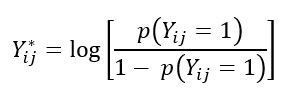

The level 1 part of Eq. (1)

explains the dependent variable, Y*

ij

:

which is the log odds that the entrepreneur 𝑖 in country 𝑗 is involved in a business as member

of a team; β0𝑗 is the intercept for country 𝑗; X𝑖𝑗 is the vector of individual-specific explanatory

variables measured at level 1 and β1𝑗 represents their corresponding direct effect coefficients;

and V𝑖𝑗 is the vector of individual-specific control variables measured at level 1 and β2

represents their corresponding coefficients. The level 2 part of Eq. (1) indicates that the level 1

intercept β0𝑗 is a function of the level 2 moderator and control variables at the country level,

where 𝛾00 is the mean value of the level 1 dependent variable once controlled for the effect of

variables at level 2; Z𝑗 is the moderator variable measured at level 2 that corresponds to country j and 𝛾01 represents its main effect; 𝑊𝑗 is the vector of control variables measured at level 2

and 𝛾02 represents their corresponding coefficients; and 𝑢0𝑗 is the random effect that captures

the variability of the dependent variable across countries 𝑗. The level 2 part of the model also

indicates that the effect of level 1 explanatory variables β1𝑗 is a function of the level 2 moderator

variable, where 𝛾10 is the mean effect of the level 1 explanatory variables once controlled for

the effect of variables at level 2; 𝛾11 is the interaction effect between the level 1 explanatory

variables and the level 2 moderator variable; and 𝑢1𝑗 is the random effect that captures the

variability in the effect of level 1 explanatory variables across countries 𝑗.

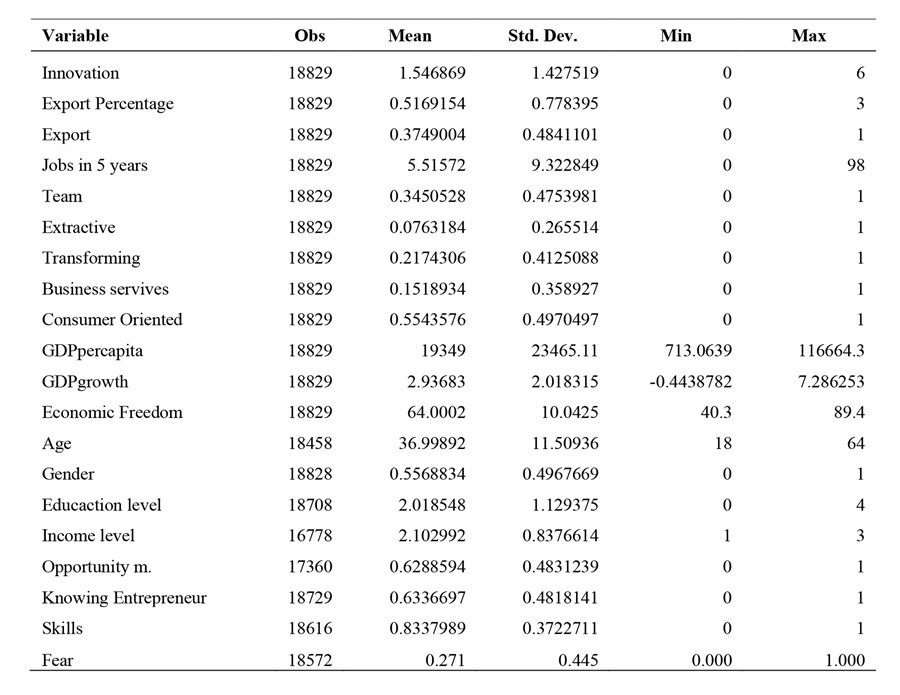

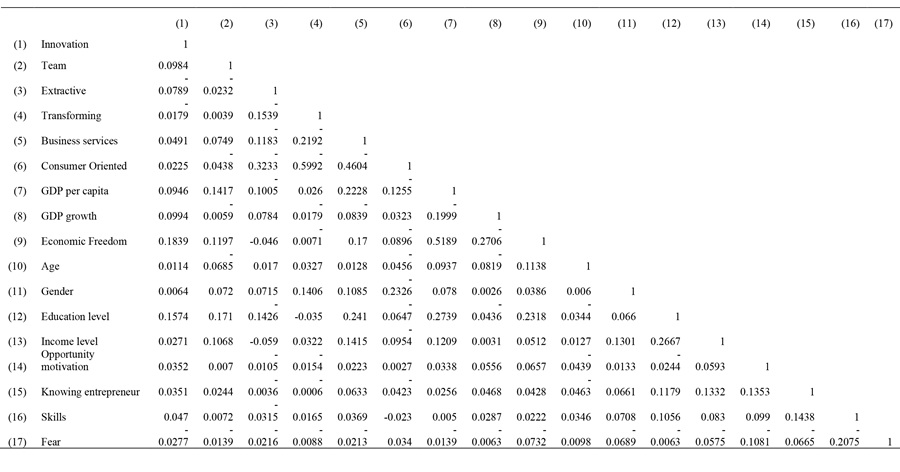

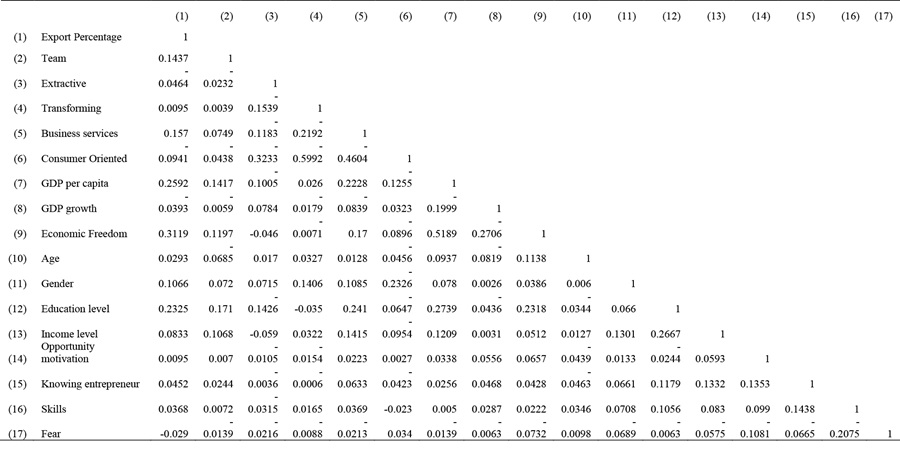

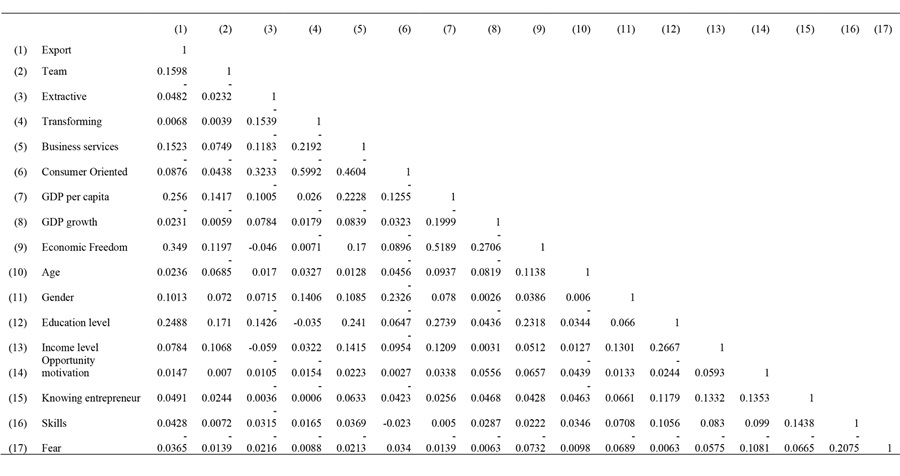

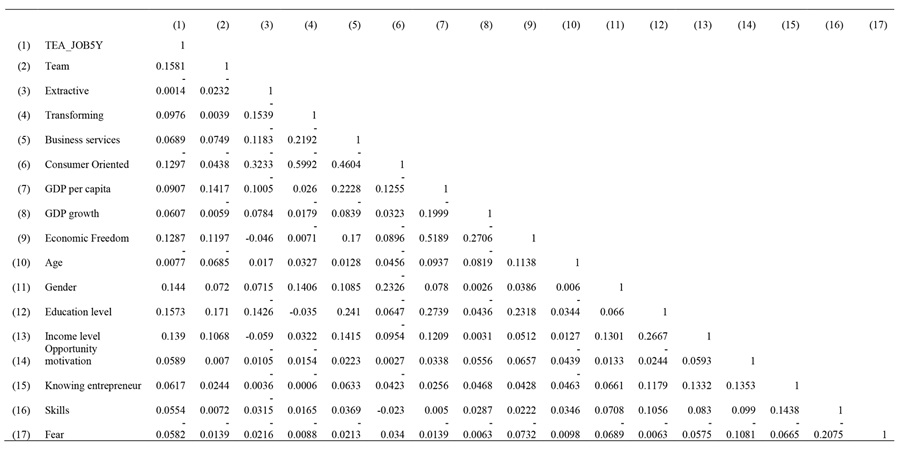

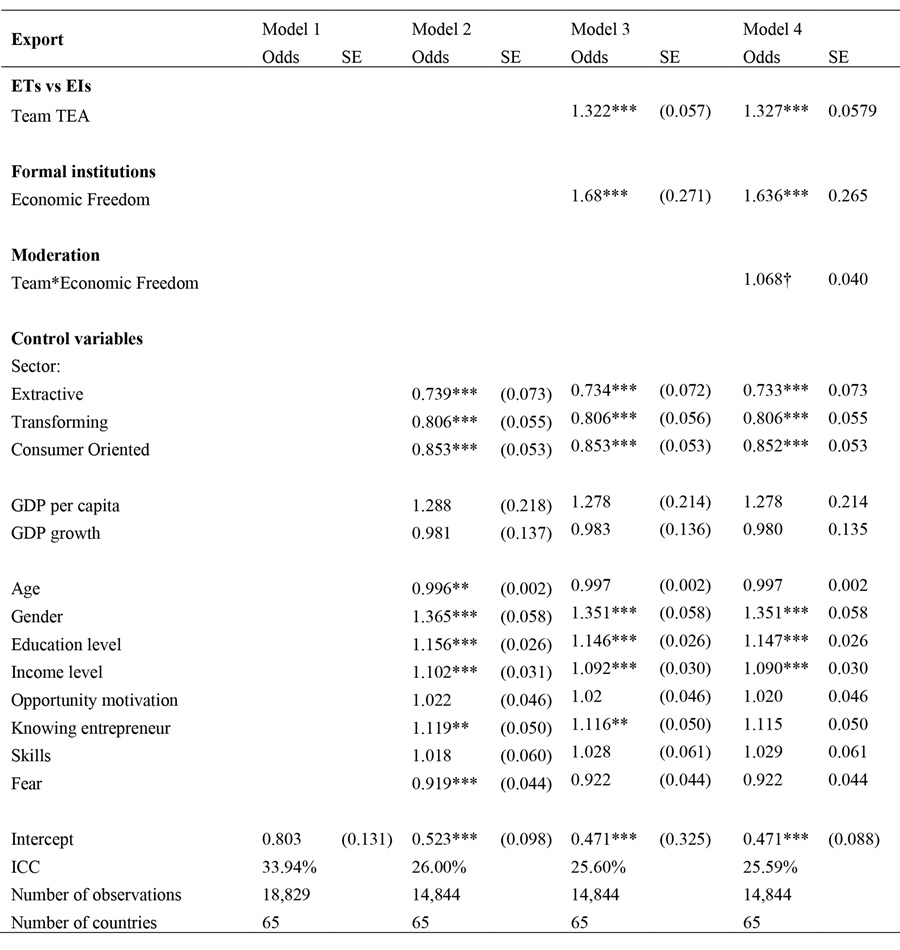

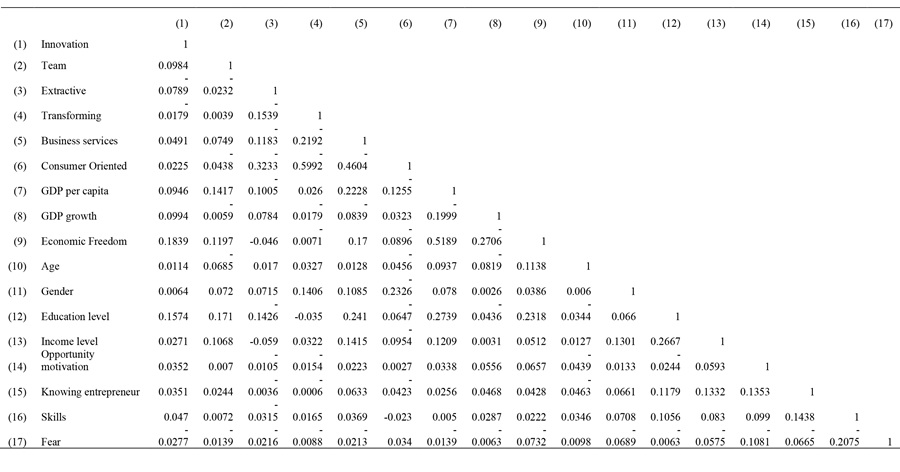

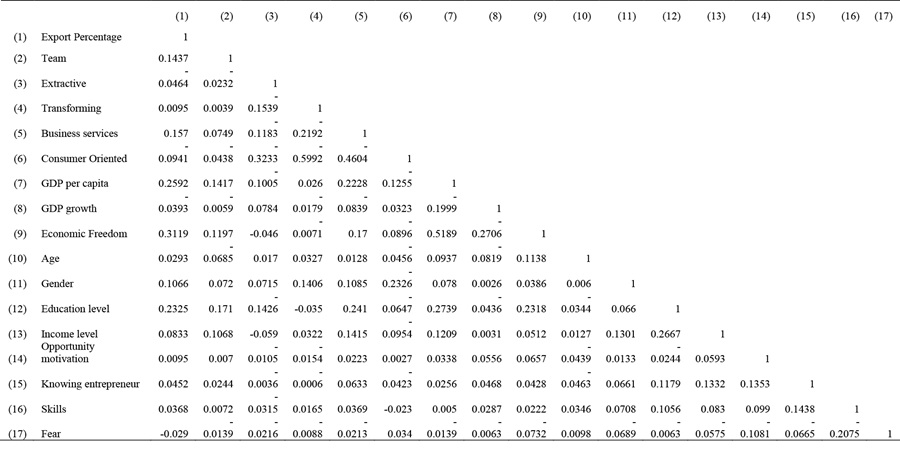

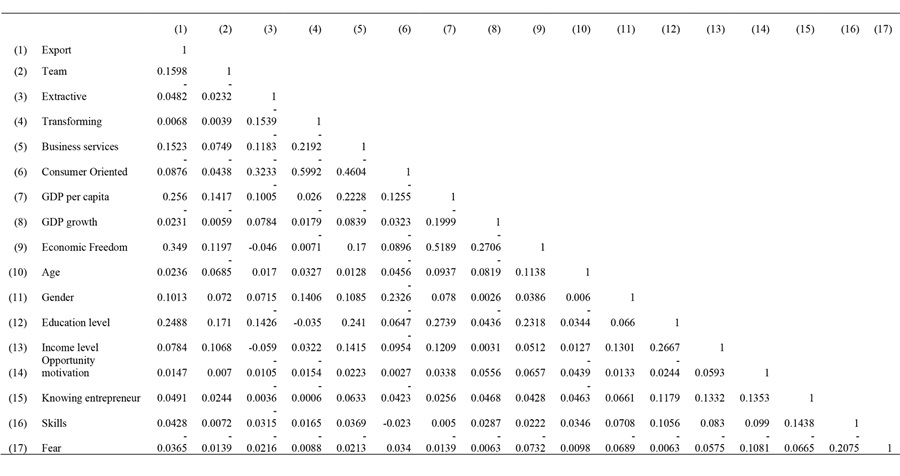

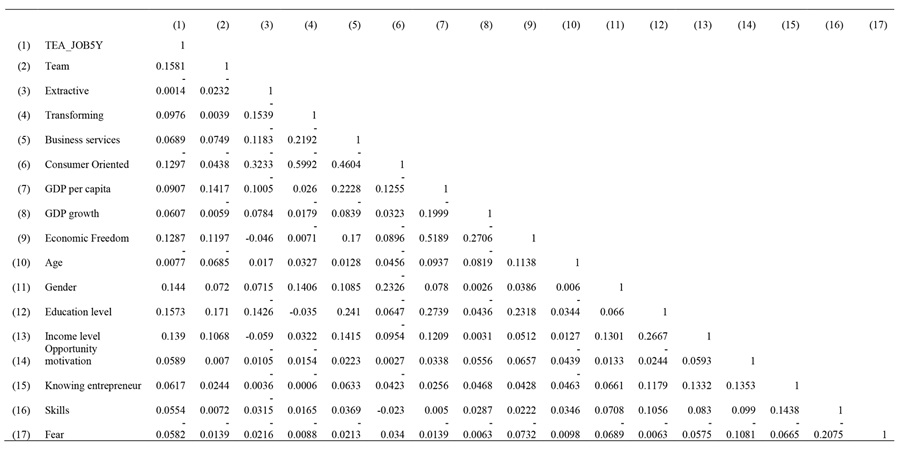

Descriptive statistics and correlation analysis

Tables 2 presents descriptive statistics from the sample of TEA. Provides the means, standard deviations and pairwise correlation coefficients for study variables. For the continuous variables, the average age of entrepreneurs in our sample is 37 years old. Tables 3, 4, 5 and 6 provide correlation matrixes for the entire sample for the 2014-2016. The correlation matrix reveals that almost all explanatory variables have a low correlation.

Table 2

Descriptive statistics

Source: Own elaboration.

Table 3

Correlation matrix

Source: Own elaboration.

Table 4

Correlation matrix

Source: Own elaboration.

Table 5

Correlation matrix

Source: Own elaboration.

Table 6

Correlation matrix

Source: Own elaboration.

Results

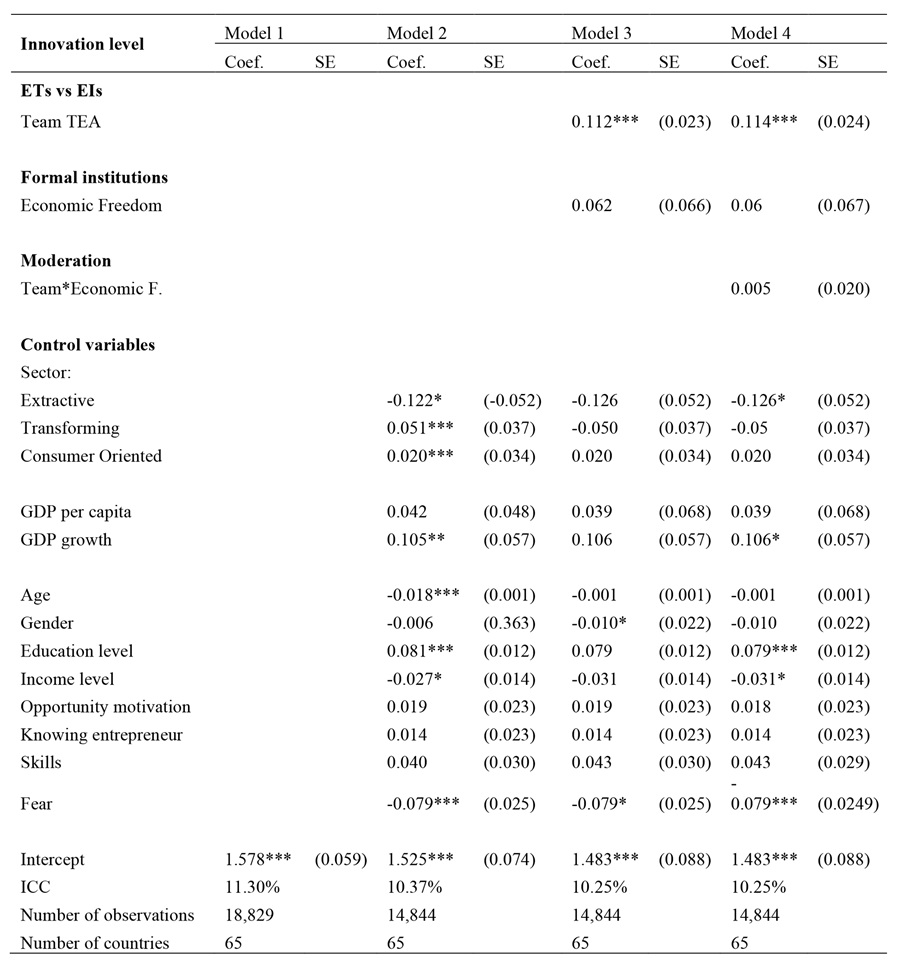

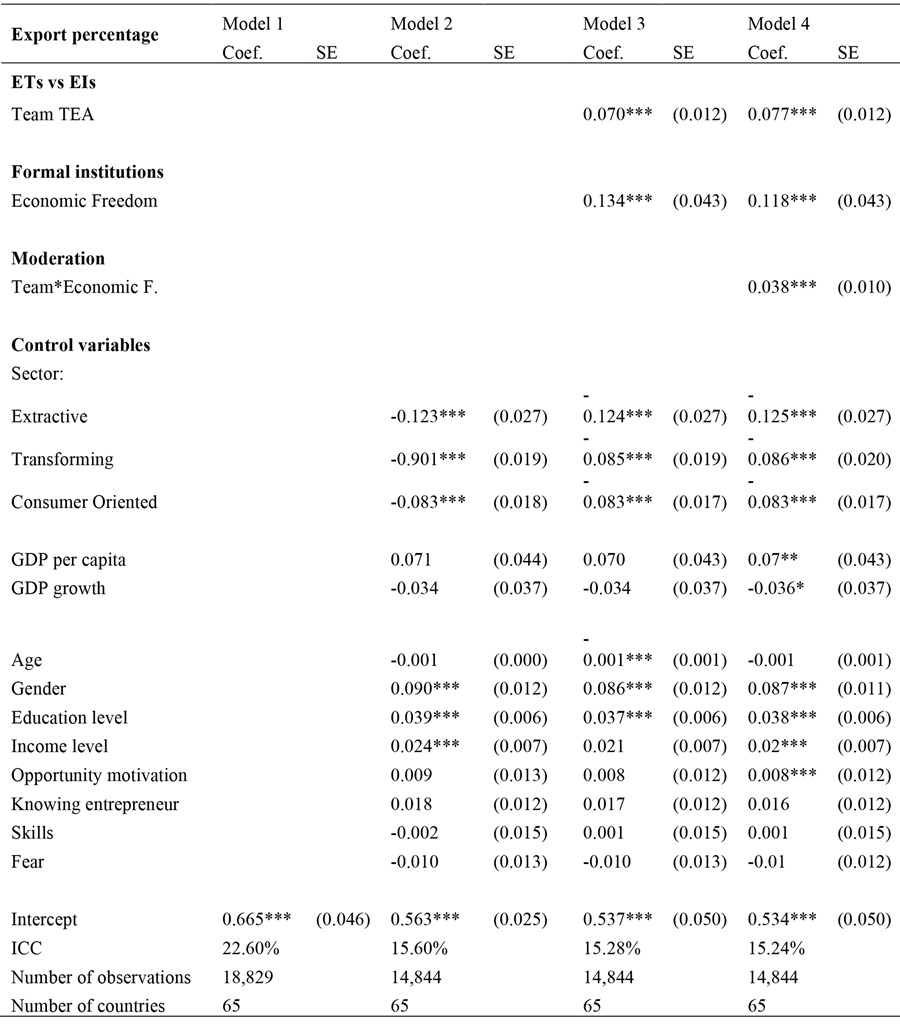

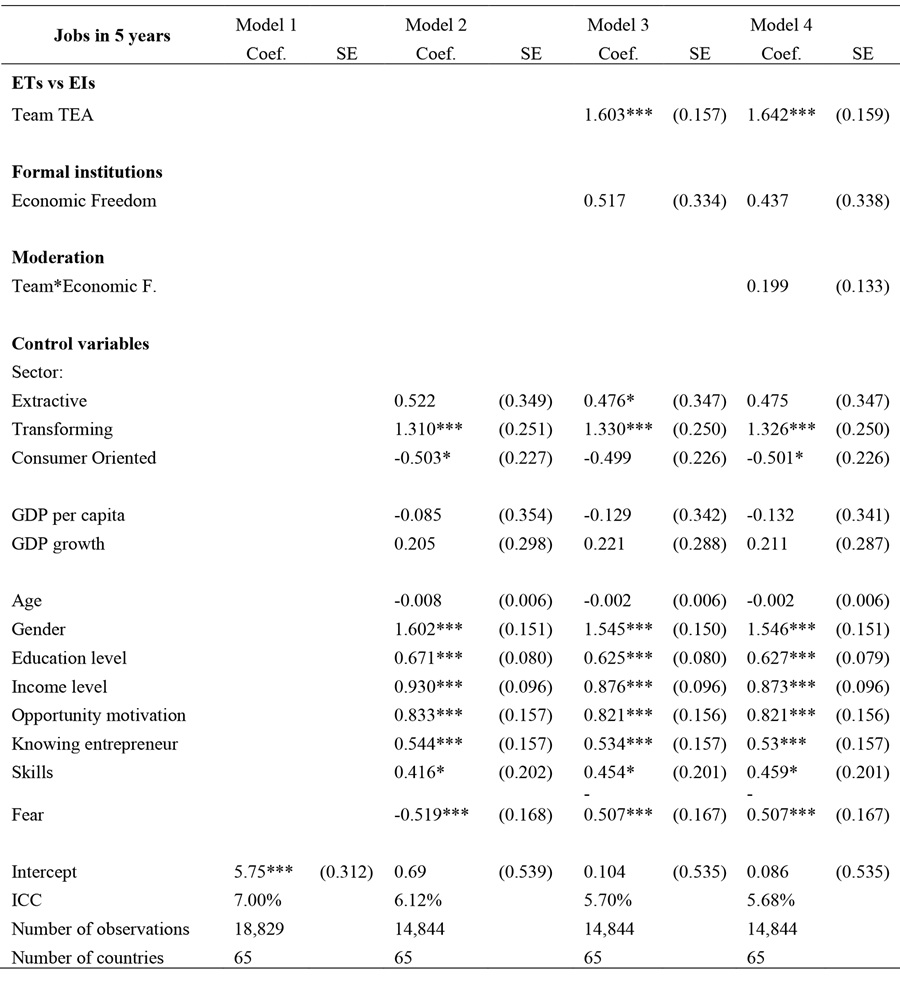

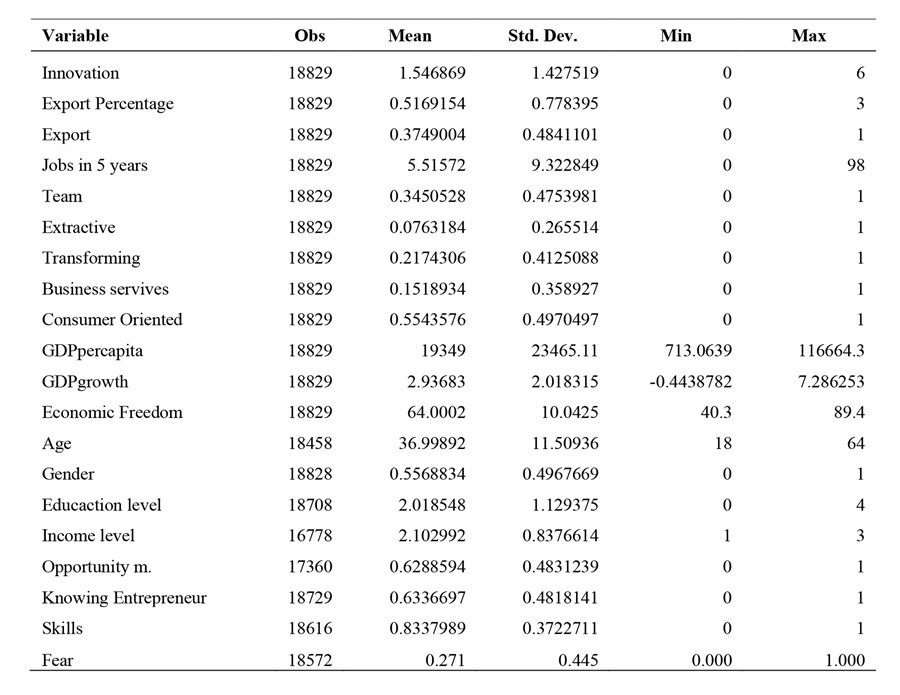

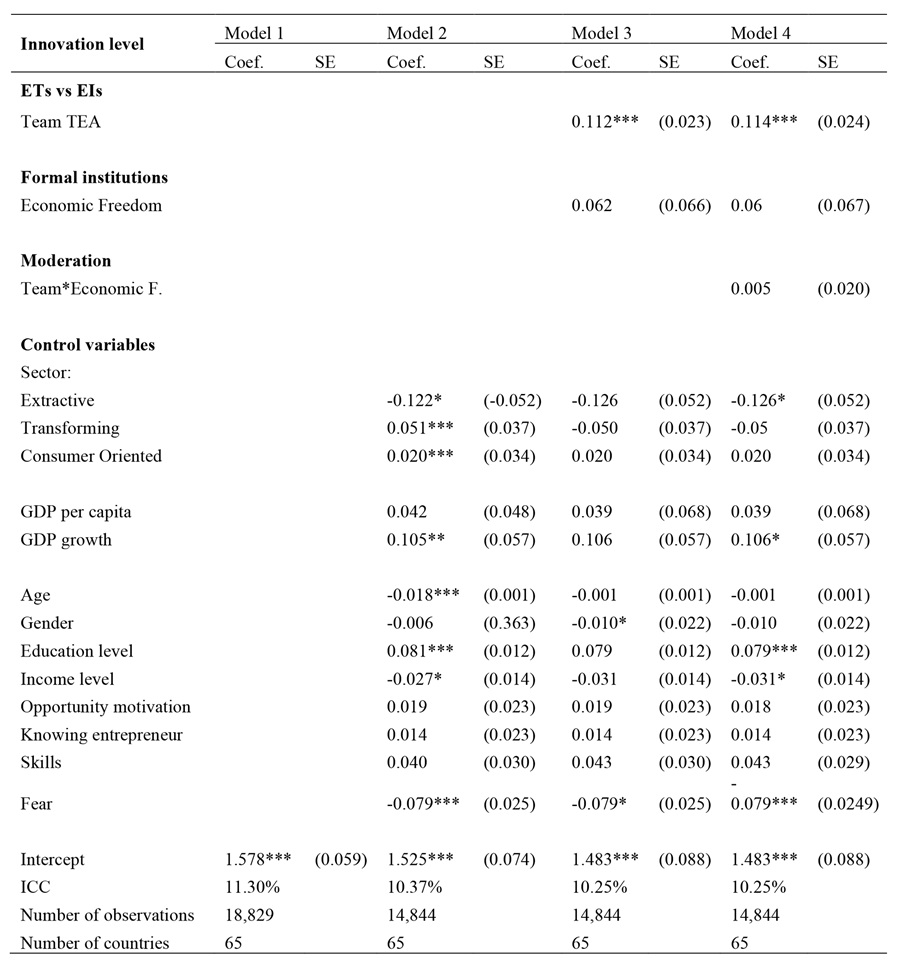

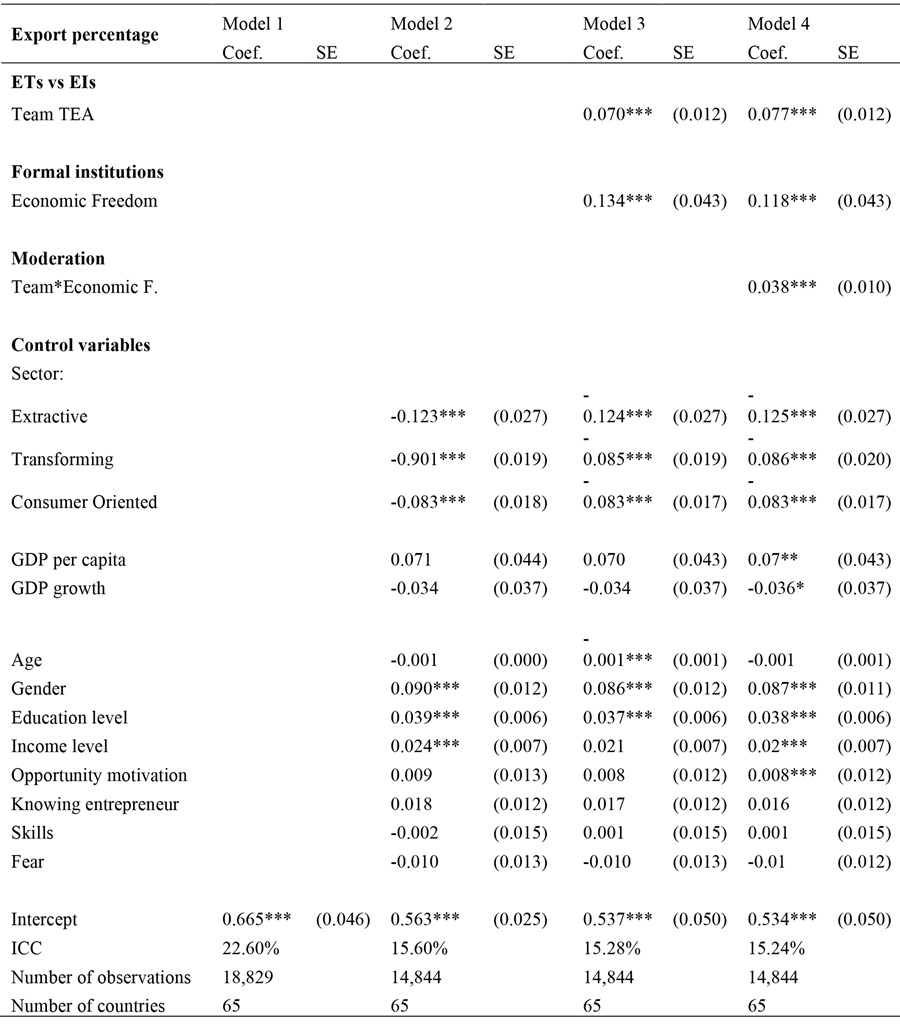

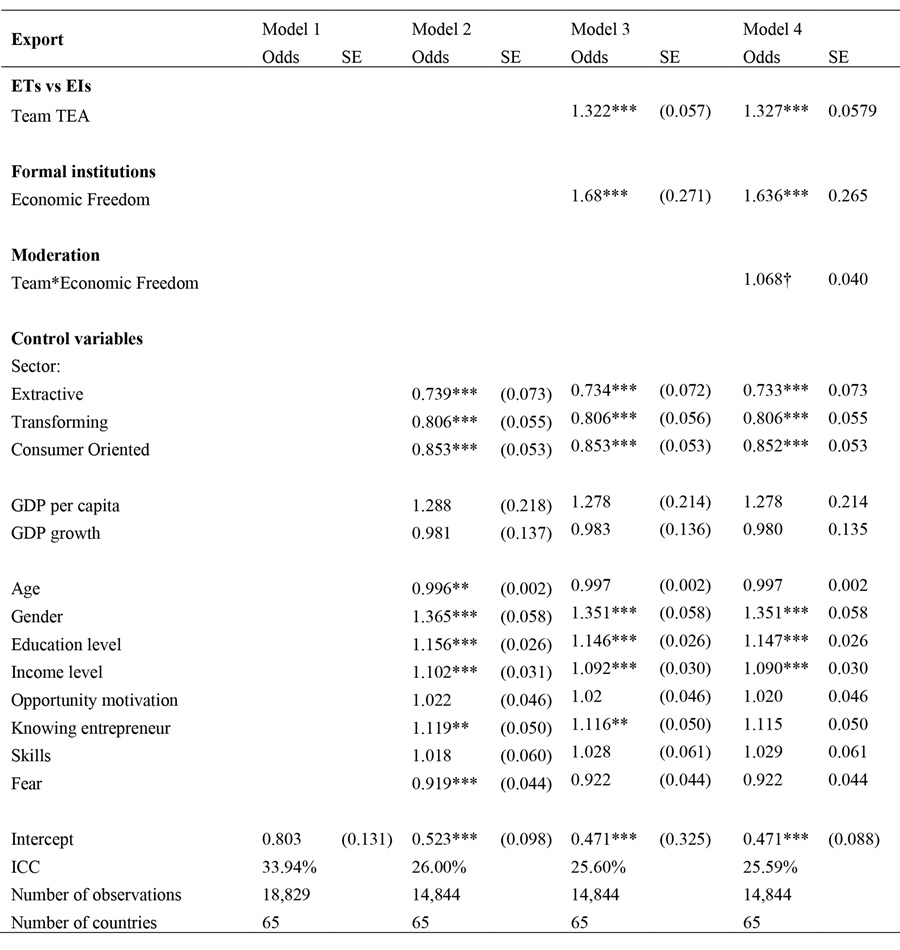

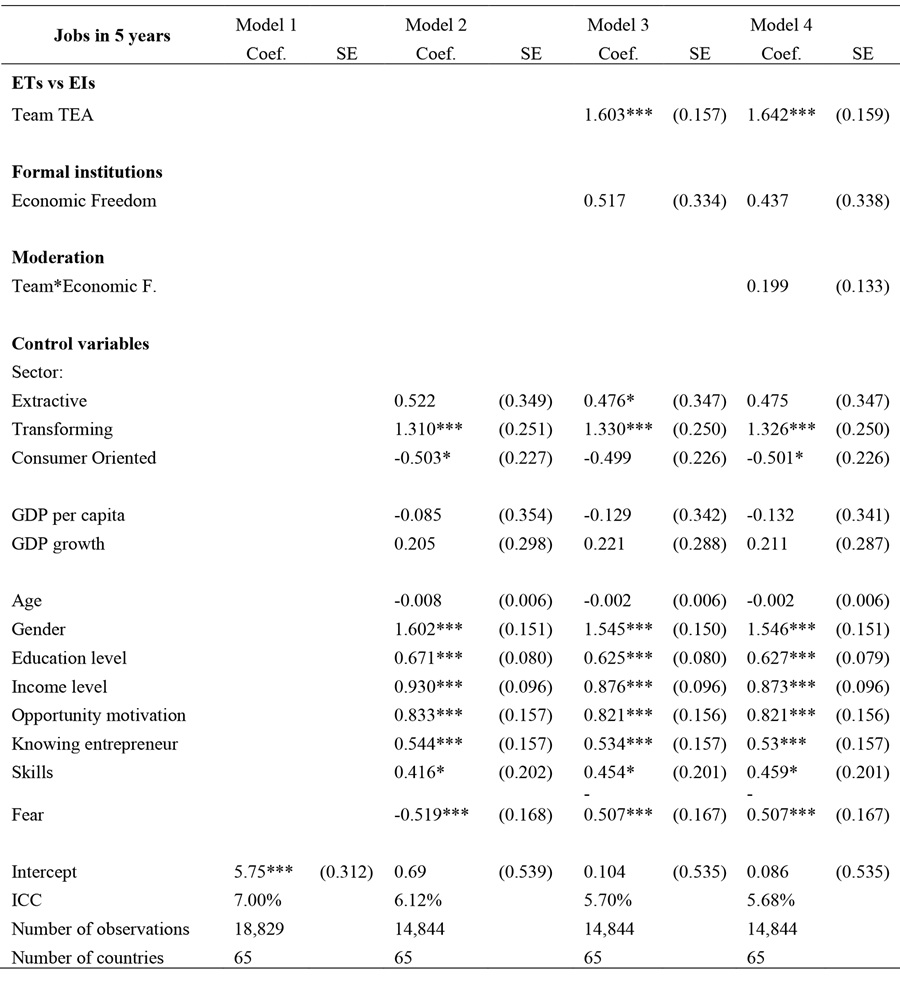

In tables 7, 8, 9 and 10, model 1 is a null model in which no explanatory variables were included for testing if there is (or is not) significant variation in the innovation, internationalisation, and employment generation. The resulting Intra-Class Correlation (ICC) shows that 11.30% of the total variance within innovation is between countries; 22.60% of the total variance within internationalisation is between countries and, 7% of the total variance within employment generation is between countries. All percentages show that multilevel model regression is the model that suits the relationships between variables. Model 2 presents the mixed regressions results with only control variables. In model 3 we incorporated the individual level and country level variable Economic Freedom and all individual level coefficients are significant (p≤0.001) and with the expected sign. Entrepreneurial teams create more innovate firms, more internationalised firms and more high employment growth firms when compared to individual entrepreneurs. We can confirm hypotheses 1,2 and 3.

In model 4 we incorporate the interaction terms between the Economic Freedom and our variable of interest (Team). We can confirm hypothesis 4b. We can conclude that a country with higher level of economic freedom positively moderates the relationship between entrepreneurial teams and internationalisation. The interaction terms for innovation and employment generation have the expected sign, however, those interactions terms are not significant, rejecting hypothesis 4a and 4c.

Table 7

Multilevel mixed regression predicting innovation

† Significant at p ≤ 0,1; *** significant at p ≤ 0,001; ** significant

at p ≤ 0,01; * significant at p ≤ 0,05

Source: Own elaboration.

Table 8

Multilevel mixed regression predicting internationalisation

† Significant at p ≤ 0,1; *** significant at

p ≤ 0,001; ** significant at p ≤ 0,01; * significant at p ≤ 0,05

Source: Own elaboration.

Table 9

Multilevel logistic

regression predicting internationalization

† Significant at p ≤ 0,1; *** significant at

p ≤ 0,001; ** significant at p ≤ 0,01; * significant at p ≤ 0,05

Source: Own elaboration.

Table 10

Multilevel mixed regression

predicting employment generation

† Significant at p ≤ 0,1; *** significant at

p ≤ 0,001; ** significant at p ≤ 0,01; * significant at p ≤ 0,05

Source: Own elaboration.

Discussions and Conclusions

This study posed a central question: do entrepreneurial teams generate firms with higher levels of innovation, internationalisation and employment growth compared to individual entrepreneurs, and how does Economic Freedom influence these relationships? Based on this question, the research seeks to provide empirical evidence on the differential contribution of entrepreneurial teams versus individual entrepreneurs, looking at both micro factors (resources and capabilities) and institutional conditions. The framework of analysis combines Resource and Capabilities Theory with elements of institutional theory, which allows for a comprehensive approach to the entrepreneurial phenomenon.

The results show that entrepreneurial teams do indeed tend to create more innovative, internationalised firms with higher employment generation expectations. These findings support the theoretical perspective by demonstrating that teams not only have more resources at their disposal, but also manage to combine them synergistically, enhancing their strategic value. Cognitive diversity, complementarity of skills and the ability to cope with complex and changing environments reinforce the idea that teams are better able to build sustainable competitive advantages from the early stages of entrepreneurship.

Contrasting these findings with previous studies confirms the findings of Klotz et al. (2014) and Ensley & Pearce (2001), who highlighted the importance of collective learning, networking and human capital in team dynamics. It also highlights the theoretical contribution of the study by showing that the context of economic freedom acts as a moderator in the relationship between teams and internationalisation. This result suggests that a favourable institutional environment can amplify team capabilities to compete in international markets, providing empirical evidence that connects institutional theory with entrepreneurial performance.

Although the effects of Economic Freedom on innovation and employment generation did not reach statistical significance, the positive effect on internationalisation is robust and suggestive. This opens new lines of research on which dimensions of Economic Freedom are more influential according to the type of entrepreneurial outcome. Moreover, it invites to explore possible indirect or mediating effects that explain why some aspects of the institutional environment affect certain dimensions of entrepreneurial performance more than others. This finer focus could enrich future research with greater theoretical and methodological specificity.

From a public policy perspective, the findings have clear implications: rather than promoting business creation in a generic way, policies should focus on creating conditions that favour the formation of entrepreneurial teams and on strengthening key aspects of economic freedom, such as trade freedom, regulatory stability and openness to foreign investment. This approach would make it possible to boost internationalisation and, in the medium term, increase the competitiveness of productive systems. In sum, this research provides an integrative framework that articulates individual capabilities and institutional contexts and offers an empirical basis for redesigning entrepreneurship promotion strategies with criteria of quality, sustainability and impact.

Transparency and ethics statements

Ethical Considerations: This

research did not require ethical approval.

Author contributions: Nathaly Pinzón, the first author, was a doctoral student and prepared the manuscript. José Luis González, her doctoral thesis advisor, revised and improved the manuscript.

Funding: This article constitutes a chapter from the lead author’s doctoral thesis. Funding was provided by the UNESCO Chair and Banco Santander.

Conflicts of Interest: No conflicts of interest are associated with the development of this research.

Declaration of Artificial Intelligence (AI) tools use: No artificial intelligence tools were used.

References

2020 Index of Economic Freedom | The Heritage Foundation. (n.d.). Retrieved October 19, 2020, from http://www.heritage.org/index/about

Acs, Z. J. (2010). High-Impact Entrepreneurship. In Z. J. Acs & D. B. Audretsch (Eds.), Handbook of Entrepreneurship Research: An Interdisciplinary Survey and Introduction (pp. 165–182). Springer. https://doi.org/10.1007/978-1-4419-1191-9_7

Agarwal, R., Audretsch, D., & Sarkar, M. B. (2007). The process of creative construction: Knowledge spillovers, entrepreneurship, and economic growth. Strategic Entrepreneurship Journal, 1(3–4), 263–286. https://doi.org/10.1002/sej.36

Aldrich, & Kim. (2007). Small worlds, infinite possibilities? How social networks affect entrepreneurial team formation and search. Strategic Entrepreneurship Journal, 1(1–2), 147–165. https://doi.org/10.1002/sej.8

Alvarez, S. A., & Busenitz, L. W. (2001). The entrepreneurship of resource-based theory. Journal of Management, 27(6), 755–775. https://doi.org/10.1177/014920630102700609

Arenius, P., & Autio, E. (2006). Financing of small businesses: Are Mars and Venus more alike than different? Venture Capital, 8(2), 93–107. https://doi.org/10.1080/13691060500433793

Arenius, P., & Clercq, D. D. (2005). A Network-based Approach on Opportunity Recognition. Small Business Economics, 24(3), 249–265. https://doi.org/10.1007/s11187-005-1988-6

Audretsch, D. B. (2004). Sustaining Innovation and Growth: Public Policy Support for Entrepreneurship. Industry and Innovation, 11(3), 167–191. https://doi.org/10.1080/1366271042000265366

Autio, E., George, G., & Alexy, O. (2011). International Entrepreneurship and Capability Development—Qualitative Evidence and Future Research Directions. Entrepreneurship Theory and Practice, 35(1), 11–37. https://doi.org/10.1111/j.1540-6520.2010.00421.x

Autio, E., Pathak, S., & Wennberg, K. (2013). Consequences of cultural practices for entrepreneurial behaviors. Journal of International Business Studies, 44(4), 334–362. https://doi.org/10.1057/jibs.2013.15

Barney, J. B. (1996). The Resource-Based Theory of the Firm. Organization Science, 7(5), 469–469. https://doi.org/10.1287/orsc.7.5.469

Barney, J. B. (2000). Firm resources and sustained competitive advantage (reprinted from JAI Press/Ablex, 1991). Advances in Strategic Management, 17(17), 203–227.

Baumol, W. J. (1996). Entrepreneurship: Productive, unproductive, and destructive. Journal of Business Venturing, 11(1), 3–22. https://doi.org/10.1016/0883-9026(94)00014-X

Bloodgood, J. M., Sapienza, H. J., & Almeida, J. G. (1996). The Internationalization of New High-Potential U.S. Ventures: Antecedents and Outcomes. Entrepreneurship Theory and Practice, 20(4), 61–76. https://doi.org/10.1177/104225879602000405

Bosma, N. (2012). The Global Entrepreneurship Monitor (GEM) and Its Impact on Entrepreneurship Research. Foundations and Trends® in Entrepreneurship, 9. https://doi.org/10.1561/0300000033

Brush, C. G., Edelman, L. F., & Manolova, T. (2002). The Impact of Resources on Small Firm Internationalization. Journal of Small Business Strategy, 13(1), Article 1.

Brush, C. G., Greene, P. G., & Hart, M. M. (2001). From initial idea to unique advantage: The entrepreneurial challenge of constructing a resource base. Academy of Management Perspectives, 15(1), 64–78. https://doi.org/10.5465/ame.2001.4251394

Busenitz, L. W., Fiet, J. O., & Moesel, D. D. (2005). Signaling in Venture Capitalist—New Venture Team Funding Decisions: Does it Indicate Long–Term Venture Outcomes? Entrepreneurship Theory and Practice, 29(1), 1–12. https://doi.org/10.1111/j.1540-6520.2005.00066.x

Busenitz, L. W., & Lau, C.-M. (1996). A Cross-Cultural Cognitive Model of New Venture Creation. Entrepreneurship Theory and Practice, 20(4), 25–40. https://doi.org/10.1177/104225879602000403

Casillas, J. C., Moreno, A. M., Acedo, F. J., Gallego, M. A., & Ramos, E. (2009). An integrative model of the role of knowledge in the internationalization process. Journal of World Business, 44(3), 311–322. https://doi.org/10.1016/j.jwb.2008.08.001

Cassar, G. (2004). The financing of business start-ups. Journal of Business Venturing, 19(2), 261–283. https://doi.org/10.1016/S0883-9026(03)00029-6

Cassar, G. (2006). Entrepreneur opportunity costs and intended venture growth. Journal of Business Venturing, 21(5), 610–632. https://doi.org/10.1016/j.jbusvent.2005.02.011

Cassar, G. (2010). Are individuals entering self-employment overly optimistic? An empirical test of plans and projections on nascent entrepreneur expectations. Strategic Management Journal, 31(8), 822–840. https://doi.org/10.1002/smj.833

Chandler, G. N., Honig, B., & Wiklund, J. (2005). Antecedents, moderators, and performance consequences of membership change in new venture teams. Journal of Business Venturing, 20(5), 705–725. https://doi.org/10.1016/j.jbusvent.2004.09.001

Chen, M.-H. (2007). Entrepreneurial Leadership and New Ventures: Creativity in Entrepreneurial Teams. Creativity and Innovation Management, 16(3), 239–249. https://doi.org/10.1111/j.1467-8691.2007.00439.x

Chen, M.-H., & Wang, M.-C. (2008). Social networks and a new venture’s innovative capability: The role of trust within entrepreneurial teams. R&D Management, 38(3), 253–264. https://doi.org/10.1111/j.1467-9310.2008.00515.x

Choi, Y. R., Lévesque, M., & Shepherd, D. A. (2008). When should entrepreneurs expedite or delay opportunity exploitation? Journal of Business Venturing, 23(3), 333–355. https://doi.org/10.1016/j.jbusvent.2006.11.001

Chowdhury, S. (2005). Demographic diversity for building an effective entrepreneurial team: Is it important? Journal of Business Venturing, 20(6), 727–746. https://doi.org/10.1016/j.jbusvent.2004.07.001

Conner, K. R. (1991). A Historical Comparison of Resource-Based Theory and Five Schools of Thought Within Industrial Organization Economics: Do We Have a New Theory of the Firm? Journal of Management, 17(1), 121–154. https://doi.org/10.1177/014920639101700109

Conner, K. R., & Prahalad, C. K. (1996). A Resource-Based Theory of the Firm: Knowledge Versus Opportunism. Organization Science, 7(5), 477–501. https://doi.org/10.1287/orsc.7.5.477

Coviello, N. E. (2006). The network dynamics of international new ventures. Journal of International Business Studies, 37(5), 713–731. https://doi.org/10.1057/palgrave.jibs.8400219

Danis, W. M., De Clercq, D., & Petricevic, O. (2011). Are social networks more important for new business activity in emerging than developed economies? An empirical extension. International Business Review, 20(4), 394–408. https://doi.org/10.1016/j.ibusrev.2010.08.005

De Clercq, D., Lim, D. S. K., & Oh, C. H. (2013). Individual–Level Resources and New Business Activity: The Contingent Role of Institutional Context. Entrepreneurship Theory and Practice, 37(2), 303–330. https://doi.org/10.1111/j.1540-6520.2011.00470.x

Dimov, D. P., & Shepherd, D. A. (2005). Human capital theory and venture capital firms: Exploring “home runs” and “strike outs.” Journal of Business Venturing, 20(1), 1–21. https://doi.org/10.1016/j.jbusvent.2003.12.007

Ensley, M. D., Garland, J. W., & Carland, J. C. (2000). Investigating the Existence of the Lead Entrepreneur. Journal of Small Business Management, 38(4), 59.

Ensley, M. D., & Hmieleski, K. M. (2005). A comparative study of new venture top management team composition, dynamics and performance between university-based and independent start-ups. Research Policy, 34(7), 1091–1105. https://doi.org/10.1016/j.respol.2005.05.008

Ensley, M. D., & Pearce, C. L. (2001). Shared cognition in top management teams: Implications for new venture performance. Journal of Organizational Behavior, 22(2), 145–160. https://doi.org/10.1002/job.83

Ensley, M. D., Pearson, A., & Pearce, C. L. (2003). Top management team process, shared leadership, and new venture performance: A theoretical model and research agenda. Human Resource Management Review, 13(2), 329–346. https://doi.org/10.1016/S1053-4822(03)00020-2

Fuentelsaz, L., Maicas, J. P., & Montero, J. (2018). Entrepreneurs and innovation: The contingent role of institutional factors. International Small Business Journal, 36(6), 686–711. https://doi.org/10.1177/0266242618766235

Gonzalez-Pernia, J. L., Jung, A., & Pena, I. (2015). Innovation-driven entrepreneurship in developing economies. Entrepreneurship and Regional Development, 27(9–10), 555–573. https://doi.org/10.1080/08985626.2015.1075602

Gupta, V., MacMillan, I. C., & Surie, G. (2004). Entrepreneurial leadership: Developing and measuring a cross-cultural construct. Journal of Business Venturing, 19(2), 241–260. https://doi.org/10.1016/S0883-9026(03)00040-5

Gwartney, J., & Lawson, R. (2003). The concept and measurement of economic freedom. European Journal of Political Economy, 19(3), 405–430. https://doi.org/10.1016/S0176-2680(03)00007-7

Harper, D. A. (2008). Towards a theory of entrepreneurial teams. Journal of Business Venturing, 23(6), 613–626. https://doi.org/10.1016/j.jbusvent.2008.01.002

Hermans, J., Vanderstraeten, J., van Witteloostuijn, A., Dejardin, M., Ramdani, D., & Stam, E. (2015). Ambitious Entrepreneurship: A Review of Growth Aspirations, Intentions, and Expectations. In Entrepreneurial Growth: Individual, Firm, and Region (Vol. 17, pp. 127–160). Emerald Group Publishing Limited. https://doi.org/10.1108/S1074-754020150000017011

Hmieleski, K. M., & Ensley, M. D. (2007). A contextual examination of new venture performance: Entrepreneur leadership behavior, top management team heterogeneity, and environmental dynamism. Journal of Organizational Behavior, 28(7), 865–889. https://doi.org/10.1002/job.479

Jin, L., Madison, K., Kraiczy, N. D., Kellermanns, F. W., Crook, T. R., & Xi, J. (2017). Entrepreneurial Team Composition Characteristics and New Venture Performance: A Meta-Analysis. Entrepreneurship Theory and Practice, 41(5), 743–771. https://doi.org/10.1111/etap.12232

Jones, M. V., Coviello, N., & Tang, Y. K. (2011). International Entrepreneurship research (1989–2009): A domain ontology and thematic analysis. Journal of Business Venturing, 26(6), 632–659. https://doi.org/10.1016/j.jbusvent.2011.04.001

Klotz, A. C., Hmieleski, K. M., Bradley, B. H., & Busenitz, L. W. (2014). New Venture Teams: A Review of the Literature and Roadmap for Future Research. Journal of Management, 40(1), 226–255. https://doi.org/10.1177/0149206313493325

Kolvereid, L. (1992). Growth aspirations among Norwegian entrepreneurs. Journal of Business Venturing, 7(3), 209–222. https://doi.org/10.1016/0883-9026(92)90027-O

Kwon, S.-W., & Arenius, P. (2010). Nations of entrepreneurs: A social capital perspective. Journal of Business Venturing, 25(3), 315–330. https://doi.org/10.1016/j.jbusvent.2008.10.008

Lau, C.-M., & Busenitz, L. W. (2001). Growth Intentions of Entrepreneurs in a Transitional Economy: The People’s Republic of China. Entrepreneurship Theory and Practice, 26(1), 5–20. https://doi.org/10.1177/104225870102600101

Lazar, M., Miron-Spektor, E., Agarwal, R., Erez, M., Goldfarb, B., & Chen, G. (2019). Entrepreneurial Team Formation. Academy of Management Annals, 14(1), 29–59. https://doi.org/10.5465/annals.2017.0131

Lechler, T. (2001). Social Interaction: A Determinant of Entrepreneurial Team Venture Success. Small Business Economics, 16(4), 263–278. https://doi.org/10.1023/A:1011167519304

Luke, D. (2004). Multilevel Modeling. SAGE Publications, Inc. https://doi.org/10.4135/9781412985147

Macmillan, I. C., Block, Z., & Narasimha, P. N. S. (1986). Corporate venturing: Alternatives, obstacles encountered, and experience effects. Journal of Business Venturing, 1(2), 177–191. https://doi.org/10.1016/0883-9026(86)90013-3

Moreno, A. M., & Casillas, J. C. (2007). High-growth SMEs versus non-high-growth SMEs: A discriminant analysis. Entrepreneurship & Regional Development, 19(1), 69–88. https://doi.org/10.1080/08985620601002162

Mueller, S. L., & Thomas, A. S. (2001). Culture and entrepreneurial potential: A nine country study of locus of control and innovativeness. Journal of Business Venturing, 16(1), 51–75. https://doi.org/10.1016/S0883-9026(99)00039-7

Nofsinger, J. R., & Wang, W. (2011). Determinants of start-up firm external financing worldwide. Journal of Banking & Finance, 35(9), 2282–2294. https://doi.org/10.1016/j.jbankfin.2011.01.024

Penrose, E. (1995). The Theory of the Growth of the Firm. Oxford University Press. http://www.oxfordscholarship.com/view/10.1093/0198289774.001.0001/acprof-9780198289777

Reynolds. (1997). Who Starts New Firms? – Preliminary Explorations of Firms-in-Gestation. Small Business Economics, 9(5), 449–462. https://doi.org/10.1023/A:1007935726528

Reynolds, Bosma, N., Autio, E., Hunt, S., De Bono, N., Servais, I., Lopez-Garcia, P., & Chin, N. (2005). Global Entrepreneurship Monitor: Data Collection Design and Implementation 1998–2003. Small Business Economics, 24(3), 205–231. https://doi.org/10.1007/s11187-005-1980-1

Ruef, M. (2010). The Entrepreneurial Group: Social Identities, Relations, and Collective Action. Princeton University Press.

Shane, S. (2009). Why encouraging more people to become entrepreneurs is bad public policy. Small Business Economics, 33(2), 141–149. https://doi.org/10.1007/s11187-009-9215-5

Shepherd, D. A., Wiklund, J., & Haynie, J. M. (2009). Moving forward: Balancing the financial and emotional costs of business failure. Journal of Business Venturing, 24(2), 134–148. https://doi.org/10.1016/j.jbusvent.2007.10.002

Tang, Y. K. (2011). The Influence of networking on the internationalization of SMEs: Evidence from internationalized Chinese firms. International Small Business Journal, 29(4), 374–398. https://doi.org/10.1177/0266242610369748

Urbano, D., & Alvarez, C. (2014). Institutional dimensions and entrepreneurial activity: An international study. Small Business Economics, 42(4), 703–716. https://doi.org/10.1007/s11187-013-9523-7

Veciana, J. M., & Urbano, D. (2008). The institutional approach to entrepreneurship research. Introduction. International Entrepreneurship and Management Journal, 4(4), 365–379. https://doi.org/10.1007/s11365-008-0081-4

Vyakarnam, S., & Handelberg, J. (2005). Four Themes of the Impact of Management Teams on Organizational Performance: Implications for Future Research of Entrepreneurial Teams. International Small Business Journal, 23(3), 236–256. https://doi.org/10.1177/0266242605052072

Wasserman, N. (2012). The Founder’s Dilemmas: Anticipating and Avoiding the Pitfalls That Can Sink a Startup. Princeton University Press.

Wiklund, J., & Shepherd, D. (2003). Aspiring for, and Achieving Growth: The Moderating Role of Resources and Opportunities*. Journal of Management Studies, 40(8), 1919–1941. https://doi.org/10.1046/j.1467-6486.2003.00406.x

Wong, P. K., Ho, Y. P., & Autio, E. (2005). Entrepreneurship, Innovation and Economic Growth: Evidence from GEM data. Small Business Economics, 24(3), 335–350. https://doi.org/10.1007/s11187-005-2000-1

Notes

*

Research paper.

Author notes

a Author to receive the article correspondence. E-mail: nathalypinzonr@gmail.com

Additional information

Cited as: Pinzón R., N., & González-Pernía, J. (2024).

Entrepreneurial teams’ firms’ performance: The contingent role of

economic freedom. Cuadernos de Administración, 37. http://doi.org/10.11144/Javeriana.cao37.etfpcr

(1)

(1)