Introduction

The training of accounting professionals occurs through the institutional matrix to which they belong (Hamilton, 2013). The institutional matrix is altered by events such as globalisation (Annisette & Trivedi, 2013), corporate crises and scandals (Humphrey, 2005), growth in world trade and industrial rivalry (Gendron et al., 2006), the engagement of actors capable of influencing the thoughts and behaviours of the dominant group (Seo & Creed, 2002), an organisational governance structure (Kuhlman, 2013), new accounting legislation (Guerreiro et al., 2015; Lantto, 2014), and the emergence of new technologies, among other aspects promoted by the economic and social context. On the other hand, society increasingly demands transparency from organisations, demanding information that demonstrates social and environmental sustainability (Michelon et al., 2021). This causes changes in the regulatory system and professional accounting practices (Brouard et al., 2017; Santos et al., 2019). All this requires a new approach that goes far beyond traditional accounting records, creating opportunities for these professionals to act as business consultants (Howieson et al., 2014). In other words, the accounting profession must continually evolve in response to institutional changes for sustainability, which necessitates the development of new rules.

Formal institutional changes require adjustments in the activities carried out (Brouard et al., 2017; Santos et al., 2019) and for accounting professionals to remain up-to-date (American Institute of Certified Public Accountants [AICPA], 2011; Hamilton, 2013). On the other hand, these updates enable professionals to establish new informal institutions, recognised for their respective practices and service provision. Thus, as these services make up the portfolio of accounting activities, the possibility arises of expansion and effectiveness of their activities beyond traditional accounting, which is already formally institutionalised (Annisette & Trivedi, 2013; Brouard et al., 2017; Goretzki et al., 2013; Santos et al., 2019; Zhang et al., 2020). Therefore, the accounting profession must continually adapt to institutional changes to ensure its own sustainability.

In this sense, although the prerogatives of the accounting profession in Brazil have remained the same since 1983 (Conselho Federal de Contabilidade [CFC], 1983), and following the standard accounting routines (Durocher et al., 2007), formal institutions have changed with the implementation of international accounting standards, for example, which requires updating accounting practices. Following the process of institutional change, accounting professionals must incorporate these changes to remain involved and work with organisations, primarily as business partners, participating in organisational management (Goretzki et al., 2013). This approach aligns with market demand for their activities, promoting their sustainability. For example, the bookkeeping service, a classic accountant’s activity characterised by routine tasks such as record-keeping, data entry, and report preparation (Järvinen, 2009), should be replaced by a professional who actively participates in the organisation’s decision-making process (Goretzki et al., 2013). Furthermore, this professional must be able to guide the organisation’s behaviour to improve the practices and performance about which these organisations disclose information, especially about social and environmental issues (Michelon et al., 2021).

Therefore, based on the premise that formal institutions change over time, affecting professional practices, this study identified the main components of the accounting profession’s activities as valued by accountants and accounting users. Thus, this research identifies the value of the accounting activities listed in Resolution 560 (CFC, 1983), based on the importance attributed by accounting users and accountants. The research was conducted using a questionnaire that asked respondents to indicate the degree of importance they attributed to the activities performed by accounting professionals, as outlined in Article 3 of Resolution 560 (CFC, 1983). To analyse the responses of the 407 respondents, we employed the technique of identifying main components, which groups the responses according to the importance attributed to each question in the questionnaire.

The results indicated five main components of sustainability in accounting activities, valued by the respondents comprising the sample: a) reporting activities, such as reports resulting from accounting operations; b) strategic activities, comprising activities related to the analyses performed by the accountant and related to strategic planning; c) structural activities, i.e., activities related to the organisation’s equity structure and internal controls; d) equity activities, including activities related to the organisation’s equity; e) tax activities, comprising activities related mainly to social charges and taxes. The first two focused on management and organisational strategies related to the participatory accountant in the organisation’s decision-making process, which denotes the changes caused by the institutional matrix. The last three are related to more routine accounting issues, aligning with the traditional accountant stereotype and being more closely tied to formal accounting rules. The activities carried out by accounting must meet the needs of its users, which evolve in response to changes in the established institutional matrix, thereby setting the dynamics of the environment (Brouard et al., 2017; Ishola et al., 2018). In addition, the profession updating and valorisation involve collaborative interactions between accounting professionals, academics, and accounting users (Berry & Routon, 2020). This article presents a literature review on the activities and institutional evolution of sustainability in accounting, including methodological procedures, results, discussions, final considerations, and references.

Literature Review on Activities and Changes in the Accounting System: Challenges and Opportunities

The economic result of a society is related to its respective institutional matrix (North, 1990). The institutional matrix is configured by rules established from two perspectives: formal and informal (Macagnan, 2013; North, 1990). Formal rules are set by control organisations, which create laws, standards, and other regulations. For example, Resolution 560 of the Federal Accounting Council (CFC, 1983) regulates the activities of accounting professionals. On the other hand, the quality of the institutional matrix is also related to the effectiveness of informal rules, as expressed in the conduct of a collective, in the practical activities of professionals, and in other behaviours of a given society. Informal rules in the accounting environment are observed by the practices of accounting professionals, who interpret and apply formal rules. While the practices of accounting professionals identify informal rules, formal rules are established by oversight bodies.

It is important to highlight that the institutional matrix is not static, as it changes over time. This means that it is not enough to simply establish new accounting standards. These standards must be adopted by accounting professionals. The process of change occurs through different stages. The first stage would be homogenisation, in which the accountant would adjust their behaviour in performing their activities according to their category. The second stage would be evolution, in which the first steps are taken into unknown territories. Finally, the third stage would be reform, in which a significant transfiguration towards the new would occur (Hanson, 2001). However, for change to occur, it is necessary to adopt procedures that are consistent and coherent with professional needs, as accounting continues to address organisational problems that it initially developed (DiMaggio & Powell, 1991; Meyer & Rowan, 1977). In addition, beliefs, cultural systems, and rules provide meaning to interpret evolutionary actions (Lawrence & Shadnam, 2008). The evolution of the accounting profession and activities needs to maintain historical knowledge, while incorporating learning for transformation and changes in institutionalisation (DiMaggio & Powell, 1991; Hanson, 2001; Meyer & Rowan, 1977; Scott, 1991) to promote its sustainability. Institutions make evolution understandable and actions for change meaningful. Institutions influence professional actions and structure (Lawrence & Shadnam, 2008). In other words, institutions in the accounting field have evolved over the centuries, keeping pace with market demands.

Decree-Law 9,245 (Brazil, 1946) established the duties

of accounting professionals in Brazil. Based on these duties, Resolution 560 of

the CFC (1983) regulated the accounting profession in Brazil. Article 25 of

such a Decree-Law considered that technical accounting work involved:

a) organisation and provision of general accounting services; b) keeping

of mandatory accounting books and all necessary accounting records, and preparation

of the respective balance sheets and financial statements; and c) judicial or

extrajudicial expert assessments, review of balance sheets and general accounts,

verification of assets, permanent or periodic review of records, judicial or

extrajudicial regulation of general and common damages, assistance to the Supervisory

Boards of public limited companies, and any other technical duties conferred by

law on accounting professionals. (Brazil, 1946)

The CFC was established by Decree-Law 9245 (Brazil, 1946) as a regulatory and supervisory body for the accounting profession. Through Resolution 560, the technical work defined by the Decree-Law was divided into 48 specific professional prerogatives of accounting and 19 activities shared with other professions (CFC, 1983).

The activities of the accounting profession establish minimum routines and standards for accounting processes (Durocher et al., 2007), which must be incorporated and identified through the practices of the respective professionals. However, there may be institutionalisation of new functions or adaptations to existing accounting activities, especially those related to managerial roles that transform accounting professionals into business partners (Goretzki et al., 2013).

In this regard, technological advances and the growth of organisations are transforming the demand for accountants’ activities (Santos et al., 2019) from an operational to a management perspective, with a need for accountants with management experience (Hadid & Al-Sayed, 2021; Oyewo, 2020). In other words, the accountant, characterised by routine work such as records, data entry, reconciliations, and reporting (Järvinen, 2009), is being replaced by a more managerial accountant who participates in the management of the organisation (Goretzki et al., 2013), with a shift toward business (Granlund & Lukka, 1998). The accountant is a knowledge worker and business consultant (Howieson et al., 2014). From this perspective, it is necessary for accountants not only to meet shareholders’ expectations but also to consider sustainability issues (Rodrigues & Picard, 2022). Thus, not only are the activities inherent to the profession altered by institutional changes, but perceptions of the accountant’s profile are also not static and can change over time (Caglio et al., 2019).

Operational accounting activities will remain fundamental, but information technology has enabled systems that perform them quickly and efficiently. On the other hand, accounting professionals would need to develop strategic activities to analyse this information and effectively communicate with and support their respective users. On the other hand, Resolution 560 (CFC, 1983) would guide accounting professionals in performing their operational activities at a secondary level. This would limit the professional’s action, as companies would require an action to support a core activity of the organisation, demonstrating institutional change. The accountant would need to change their accounting practices through a formative change or retraining, breaking with the traditional number-processing mentality to assume a participatory role in developing organisational strategies and operations (Howieson et al., 2014; Spanyi, 2006; Thomson, 2009). Even small and medium-sized organisations, which typically outsource accounting activities, are seeking not only regular and routine accounting services but also guidance that enables them to analyse their business—an analysis that portrays the company’s position, allowing them to devise a strategy that leads to its growth. Technical accounting advice can assist in the process of disseminating accounting content and practices, allowing participants to become more managerially and strategically involved in the business environment. (Hadid & Al-Sayed, 2021; Zandi et al., 2019).

Among the professional accounting activities, there are several accounting operations such as accounting records, cost, and management accounting practices, practices to support the organisational decision-making process, tax rules knowledge, audit practices, and communication results ways, among others (Granlund & Lukka, 1998; Hicks et al., 2007; Howieson et al., 2014). All activities are inserted in a business organisation’s environment and a country’s cultural or globalised context, where organisations operate (Annisette & Trivedi, 2013; Goretzki et al., 2013). In other words, accounting professionals must act in accordance with the formal rules that govern the institutional matrix in which they operate.

Accounting activities are broad; however, the professional’s work may be concentrated in some areas (Hicks et al., 2007). If you are a liberal professional with an accounting firm, you must perform certain activities, usually aimed at small and medium-sized organisations. If you are an accountant of a single organisation or a holding company, your activities will be directed to the organisation or holding business. On the other hand, if the professional pursues an auditing career, working in an audit organisation, their activities will be directed towards auditing financial statements and/or consulting. Alternatively, if the professional acts as an internal auditor, their activities are directed towards operations and internal organisational controls, more specifically (Bowles et al., 2020; Brennan & Kirwan, 2015). It is also worth noting that the accounting profession is vulnerable to disruptions through automation, given the incremental and disruptive technological innovations and altered business models (Al-Htaybat et al., 2018; Berry & Routon, 2020; Bowles et al., 2020; Tongur & Engwall, 2014; Zhang et al., 2020). This requires the accounting professional to adopt a behaviour adjusted to this reality, contributing in another way to the organisation’s success.

Thus, through their activities, accounting professionals need to create relevance and value to maintain and build a sustainable future for the profession. From this perspective, the accounting professional should incorporate, in technical skills, competencies aimed at a problem-solving, creative, and communicative profile (Chartered Accountants [CA ANZ], 2017). So, this professional should develop more generic skills, such as leadership, communication, critical thinking, problem-solving, and managerial roles (Howieson et al., 2014). In addition, activities should be focused not only on the accounting field but also on the organisation’s management more broadly, including knowledge in finance, management, information technology, and sustainability (Barth, 2018; Berry & Routon, 2020; Hiramatsu, 2018; Kaplan, 2011; Rodrigues & Picard, 2022). These competencies, which permeate all professional activities, are for success in the future, which has as a backdrop, globalisation, incremental, disruptive, and demographic technological changes (Al-Htaybat et al., 2018; Bowles et al., 2020; CA ANZ, 2017; Santos et al., 2019; Zhang et al., 2020).

Shifts in the accountant’s role to a consultant or advisory role require greater skills in dealing with uncertainty (Howieson et al., 2014). This view regards professional development in accounting as a process of continuing education that emphasises “learning how to learn” in response to environmental changes and the resulting needs of the profession (Howieson et al., 2014; Martendal et al., 2020; Watson, 2006). Continuing education, which may or may not be formal, will also depend on the professional learning environment (Hicks et al., 2007). For accounting professionals, hands-on learning is quite common (Marsick & Watkins, 2001). Learning, through any method, is a competitive advantage for professionals and organisations (Al-Htaybat et al., 2018; Eddy et al., 2006; Hicks et al., 2007). The need for constant updating gained relevance with the adoption of the so-called International Financial Reporting Standards (IFRS). According to Doan et al. (2020), the qualifications and skills of accounting teams are the most impacted by the adoption of IFRS.

Brazilian legislation groups professional accounting activities into three broad categories (CFC, 1983). This research can confirm, expand, or completely revise these categories. The main components may reflect the professional profile expected today, given the constant changes in context (Brennan & Kirwan, 2015; Goretzki et al., 2013; Howieson et al., 2014).

Research Design

The research was conducted through a survey, with the questionnaire application supporting the principal component analysis (PCA) and meeting the research objective. The population consists of professionals who work in organisations, whether business-related or not, and have at least one year of experience. We adopted this criterion to capture the professional’s perception with minimum experience and reflection on accounting products. We selected two respondent groups for the survey because they are primary accounting stakeholders: professionals who work in accounting for companies or in accounting offices (referred to as professionals) and professionals who use accounting to develop their activities (referred to as users). The professionals and users chosen for accessibility were the owners, directors, managers, supervisors, analysts, and assistants, as shown in Table 1. All of them are from the metropolitan region of the Brazilian state capital.

The survey research questionnaire consisted of two parts: the first aimed to collect respondents’ demographic information, and the second sought to assess the degree to which the activities conducted by accounting professionals were attributed. Respondents provided their demographic details using multiple-choice questions. To determine the degree of importance respondents attributed to the activities performed by accounting professionals, we used the attributions provided in Article 3 of Resolution 560 on professional prerogatives (CFC, 1983).

For content validation, we submitted the questionnaire to two specialists, PhDs in accounting. Additionally, we introduced a questionnaire to evaluate the experience of 30 students in an undergraduate Accounting Sciences course at the university. The analysts read and discussed each activity listed in the correct wording and terms. After the validation and evaluation processes, 48 accounting professional-specific prerogatives were identified, and some were grouped, resulting in 30 activities for evaluation. For each activity, the respondent assigned a value using a 7-point Likert scale, ranging from 1 (least important) to 7 (most important).

We collected evidence from the Microsoft Forms tool. We sent the questionnaire in two stages, first to users and later to accounting professionals. From users, 314 responses were returned, and from professionals, 193 responses were received, resulting in a total of 507 responses and 15,182 observations. Subsequently, when submitting the answers to the validation procedures for the PCA, the sample size was reduced to 162 professionals and 245 accounting users, primarily due to a lack of responses for most activities, resulting in 407 valid answers. The resulting sample is a convenience sample, given the challenges of gathering evidence for a study of this nature.

We automatically generated two spreadsheets, exported to Excel, at the end of the two evidence collection stages. Each worksheet contained data on the respondent’s groups, users, and professionals. We manually generated a third one from these two spreadsheets, including a column to identify the respondents’ group. Then, we had data related to position, gender, experience time, and the score for each of the 30 activities performed by accounting.

We imported the spreadsheet with the unified data into the EViews software version 9.5. Initially, we analysed the data regarding the existence of missing values. The question related to the stock or shares of book value had ten missing values, representing 2.0 % of the sample for this question. The question balance sheet consolidation-related had eleven missing values, which is 2.2 %. The question balance sheet, activities related to taxes and ancillary obligations, and internal control performance evaluation had one missing value each. We did not eliminate missing values because they did not exceed 10 % of the sample (Hair et al., 2009). Finally, for the PCA, Stevens (1986) recommends a case-to-variable ratio of 5:1 to ensure a reliable analysis procedure. In this research, a ratio of 14:1 was achieved.

The next step of the PCA was to assess the suitability of professional accounting activities for the analysis. This assessment was performed using Kaiser’s sample suitability measure and Barlett’s test (Lattin et al., 2011). The Kaiser sample suitability measure assesses suitability by comparing the paired and partial correlation coefficient and assigns values between zero and one, with an acceptable minimum of 0.5 (Cortina, 1993; Figueiredo Filho & Silva Junior, 2010; Hair et al., 2009; Kaiser, 1968, 1974). Bartlett’s test is used to determine whether the variances of the variables are homogeneous (Box, 1953; Hair et al., 2009; Lattin et al., 2011).

Finally, we performed PCA and validation tests on the composite components extracted for the accounting profession activities group. Initially, we elaborated the components graph to define the number of composite components suitable for the study. Each line was analysed to determine each component’s activity according to the most strongly associated variables. The PCA organises the uncorrelated composite components based on their decreasing variance, with the first component being the one with the highest variance and the last with the lowest variance (Abdi, 2003; Lattin et al., 2011; Kim & Mueller, 1978; Williams et al., 2010). This analysis reduced the activities by grouping and maintaining the possibility of identifying the type of activity to which each one refers. At the same time, it illustrated the variance and did not change the original variables (Lattin et al., 2011; Williams et al., 2010).

Kaiser’s statistics validated the extraction of the principal components, presenting at least 0.5 values, and Cronbach’s Alpha was validated, yielding values of at least 0.7, considered acceptable for exploratory studies (Cronbach, 1951; Figueiredo Filho e Silva Junior, 2010; Hair et al., 2009; Kaiser, 1968, 1974). For Cortina (1993) and Kaiser (1968), Cronbach’s Alpha and the Kaiser measure eigenvalue must be directly related, indicating the same decision.

Results and Discussions

This topic presents the research results and discussions with the reviewed literature. The results are subdivided into respondents’ demographic information, descriptive statistics of professional accounting activities, and PCAs that form the factors derived from each set of items.

Respondents’ Demographic Information

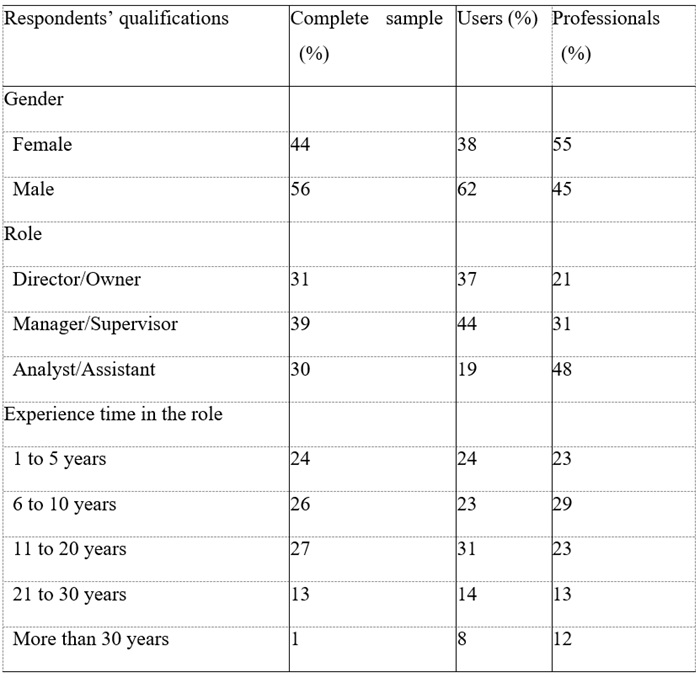

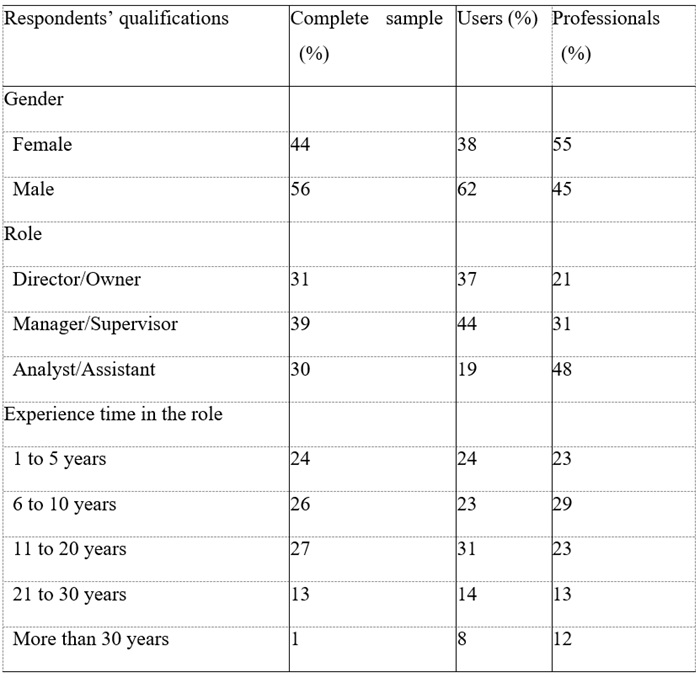

The sample, which qualified for analysis, consisted of 407 respondents, of whom 162 (40.0 %) belonged to the accounting professionals’ group (accountants) and 245 (60.0 %) to the internal accounting users’ group. Table 1 presents the profiles for the total sample and by respondent group.

Table 1.

Respondents’ Demographic Information

Source: Research results (2024).

Table 1 indicates that the male audience slightly predominates over the female audience. However, when analysed by groups, there is a female predominance among professionals and a strong male presence in the users’ group. Regarding the respondents’ positions, in the users’ group, respondents with management and supervisory positions predominate, while in the professionals’ group, those in analyst and assistant positions are more prevalent. Among the professional group, the highest concentration of respondents is those with ten years of experience. In contrast, most respondents have between 11 and 20 years of experience in the users’ group, maintaining a relationship with their positions.

Descriptive Statistics of Professional Accounting Activities

Table 2 presents the results related to the degree of importance respondents attribute to professional accounting activities. It includes the number of responses obtained, the minimum and maximum values assigned, and the mean and standard deviation of the given values. It is noteworthy that, for the evaluation of descriptive statistics and factor analysis, we performed aggregate sample analysis (407 respondents) rather than analysing the data by group of respondents.

Table 2.

Descriptive Statistics

Source: Research results (2024).

On average, the activity considered most important by the respondents was the year income statement (6.29), followed by the balance sheet (6.21) and activities related to tax calculation and ancillary obligations (6.14). Even though the dispersion is small for these three activities (1.10, 1.15, and 1.10, respectively), the income statement for the year and the activities related to tax calculation and ancillary obligations also stand out for their minimal dispersion among the respondents. This demonstrates that Brazilian accounting plays a significant fiscal role in economic and informative results and in solving managers' accounting problems (CA ANZ, 2017; Howieson et al., 2014). However, managerial and support decision-making is less valued individually (Barth, 2018; Berry & Routon, 2020; Hiramatsu, 2018; Howieson et al., 2014; Kaplan, 2011). This also demonstrates that the evolution of the institutional matrix leads to changes in consolidated professional activities (Hanson, 2001; Lawrence & Shadnam, 2008; Santos et al., 2019).

The activities that presented the lowest averages are the statement translation in foreign currency (4.57), material control systems organisation and operation (4.84), and flowchart establishment (4.92). However, the respondents do not have a consensus about these activities, as the standard deviations are higher (1.87, 1.69, and 1.56, respectively). These answers may indicate that most respondents work in small and medium-sized companies, where they do not need to play a more managerial role and focus on international organisations (Bowles et al., 2020; Brennan & Kirwan, 2015). Institutionally, the answers may reflect the country’s own stage of development in terms of institutional quality.

In addition, the answers obtained regarding the most and least important activities, as well as the intermediate ones, can also mean accounting professionals follow the installed culture and meet the needs demanded, given the institutional matrix evolution, without leading valorisation professionals initiatives focused on the business consultant role and problem solver (Annisette & Trivedi, 2013; Goretzki et al., 2013; Granlund & Lukka, 1998; Loach et al., 2017; Payne & O’Neil, 2019). On the other hand, accounting users are also comfortable with what the conjuncture offers them, accustomed to more traditional activities, meeting legal demands only, without perceiving accounting professionals as their business partners (Goretzki et al., 2013; Granlund & Lukka, 1998; Howieson et al., 2014; Järvinen, 2009; Payne & O’Neil, 2019). Thus, professional changes will intensify when the demand for new professionals also intensifies. This demand can boost institutional maturation and attract more excellent-quality investment to the country. Depending on the institutional matrix, evolution, customs, culture, and rules lead to conservatism or change in the profession.

Principal Components of the Professional Accounting Activity

To derive constructions on the groupings of professional accounting activities and identify constant environmental changes, we used PCA to obtain composite component estimates that account for the most significant variance in the sample (Norusis, 1990). We applied the PCA to the thirty items representing the activities that are the accountants’ prerogatives, according to Resolution 560 (CFC, 1983), valued by the primary stakeholders.

For the activities set, the KMO measure in the exploratory factor analysis was 0.951, which is considered adequate. Sphericity Bartlett’s test is significant (p < 0.000), which means the variables under each composite component are correlated enough to provide a reasonable basis for conducting PCA. The approximate chi-square value for Bartlett’s spheroidicity test for success factors was 9,393.644 with 435 degrees of freedom. Bartlett’s test indicated non-zero correlations at the significance level of 0.000, thus establishing its statistical validity.

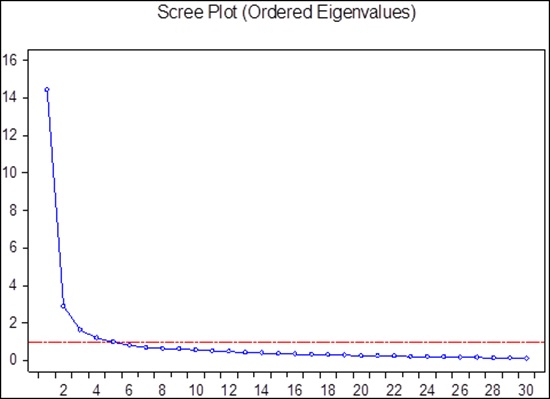

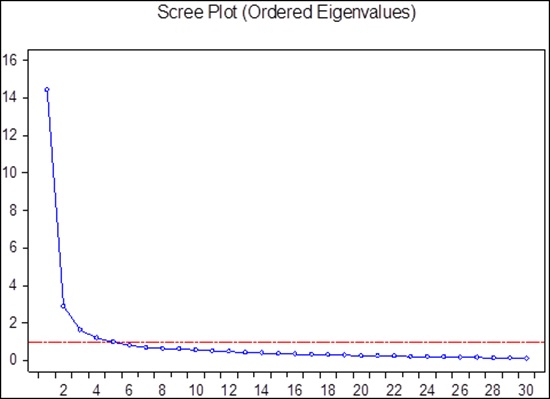

The PCA to extract the composite components related to the activities valued by the primary accounting stakeholders resulted in a five-component solution, as shown in Figure 1, following indications from the specialised literature (Churchill, 1979; Hair et al., 2009).

Figure 1.

Composite Components Number Indication

Figure 1.

Composite Components Number Indication

Source: Research results (2024).

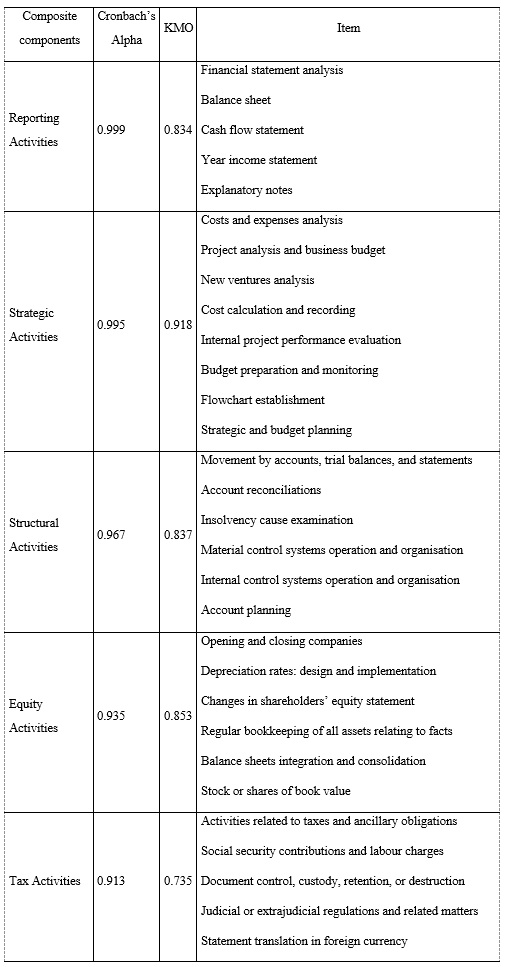

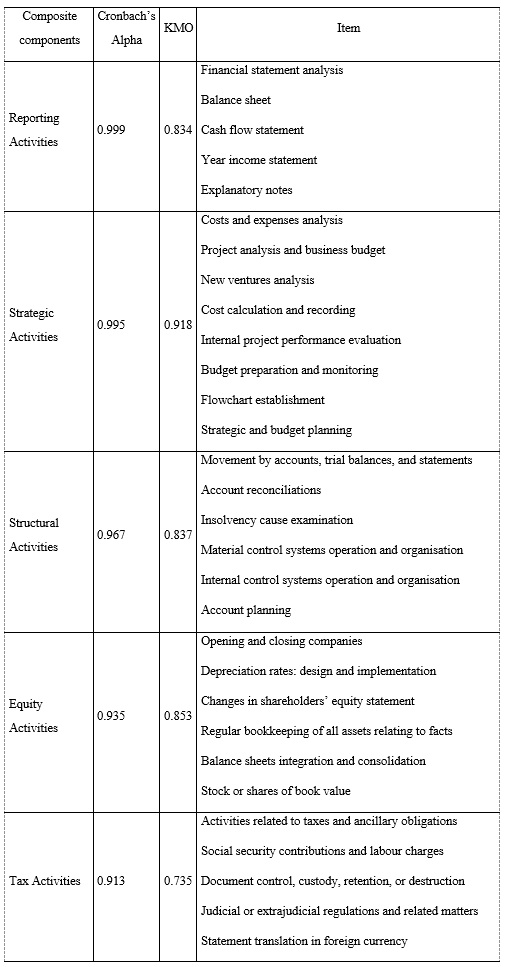

As shown in Figure 1, by the dashed line, five composite components reach the appropriate representation for all 30 activities evaluated, and any additional component adds little. Also, we evaluated the reliability and suitability of the composite components using Cronbach’s Alpha and eigenvalue (KMO). In these items, the indicators were equal to or higher than the acceptable level, as shown in Table 3.

Table 3.

Principal Component Analysis, Cronbach’s Alpha, and KMO

Source: Research results (2024).

Table 3 presents the composite components from highest to lowest Cronbach’s Alpha. The first composite component title is “Reporting Activities,” which groups items to inform various stakeholders about the organisation. It is related to the accounting purpose of generating information through reports, financial statements, and respective explanatory notes.

The first composite component groups the activities that present the organisation’s operational results, which are processed by the activities grouped in the components composed of structural, equity, and tax activities. It grouped those activities to inform stakeholders about organisations’ equity, economic, and financial positions and served as a basis for decision-making processes (Granlund & Lukka, 1998; Howieson et al., 2014). Depending on the cultural environment and organisational behaviour, accounting professionals may or may not participate in this process (Goretzki et al., 2013; Loach et al., 2017; Nowotny et al., 2022; Payne & O’Neil, 2019). That will occur if they accept these behaviours and are similar within the context in which accounting organisations and professionals operate (Granlund & Lukka, 1998; Payne & O’Neil, 2019). Oyewo et al. (2019) emphasise that the management accounting role must evolve to maintain relevance through continuous management support, which is characterised as an institutionalised accounting profession. This evolution is related to accounting aimed at its stakeholders, which has been demanding transparency from organisations, a demand that has intensified since the mid-20th century (Seibert & Macagnan, 2017). Otherwise, the view of the accounting profession becomes institutionalised as a weak accounting profession (Kristanto & Cao, 2024).

The second composite component grouped items for performance evaluations and future project organisation. Its title is “Strategic Activities.” These activities require accounting information for informed decision-making, including planning, budgeting, project management, and investment analysis. This composite component grouped essential activities for the organisation’s managerial and strategic issues. Strategic actions demonstrate that the accountant also acts as an analytical person, consultant, and business partner, assisting and participating in organisations’ strategic decision-making processes (Annisette & Trivedi, 2013; CA ANZ, 2017; Goretzki et al., 2013; Granlund & Lukka, 1998; Loach et al., 2017; Payne & O’Neil, 2019). The accounting professional assumes a managerial role, utilising more generic skills, including leadership, communication, critical thinking, and problem-solving (Howieson et al., 2014), when the institutional environment permits or requires it (Granlund & Lukka, 1998; Lawrence & Shabnam, 2008; Payne & O’Neil, 2019). For this reason, Frii and Hamberg (2021) argue that understanding the institutional context is essential when studying the causes that shape initial goodwill accounting, as it explains why the same accounting standards are applied differently in different regions of the world.

We referred to the third composite component as “Structural Activities.” It gathered items related to activities conducted before and during the organisation’s operational routines, and they are essential to achieving the goal with excellence. The fourth composite component is “Equity Activities,” as the items linked to this component refer to routine bookkeeping and reconciliation, calculations, and activities performed to ensure the accounting information accurately reflects the organisation’s equity position and is presented in the relevant statement. Finally, the fifth composite component grouped items related to the tax activities of organisations, from the most routine to the preparation of financial statements in foreign currency. These activity groupings demonstrate that there has been little institutional matrix evolution since their definition through Resolution 560 (CFC, 1983). They also indicate that these activities remain essential for accounting users and necessary to meet professional demands. They are more traditional and allow the establishment of routines and minimum standards in accounting processes (Durocher et al., 2007).

The results showed that the main stakeholders attach different degrees of importance to accounting activities. These led to the establishment of composite components that reflect the evolution of the other institutional matrices of the accounting profession processes. The composite components separately reflect the activities performed for more operational purposes and those performed for strategic objectives. In this spectrum, the ability of accountants is reflected in the technical competence and service, understood by Richardson et al. (2015) as a commitment to management, which are factors that distinguish the contemporary accountant from the traditional accountant.

Zandi et al. (2019), in a survey on accounting outsourcing among small and medium-sized companies in Malaysia, identified that SME management seeks more than the routine services of their accounting offices. They also seek strategic partners to help organisations grow. In this sense, Zandi et al.’s (2019) results align with this research and Goretzki et al. (2013). The last three composite components result from the PCA, which groups the more traditional and accounting routine activities, categorising them into pre-established and culturally conventional patterns in the profession. These activities are necessary to comply with legal issues and form the basis for accounting information (Annisette & Trivedi, 2013; Durocher et al., 2007; Granlund & Lukka, 1998; Hadid & Al-Sayed, 2021; Hicks et al., 2007; Järvinen, 2009).

These results demonstrate the priority stakeholders’ alignment with the professional needs arising from the cultural environment and the constant institutional changes that present themselves (Berry & Routon, 2020; Hanson, 2001; Howieson et al., 2014; Lee et al., 2000; Nowotny et al., 2022; Santos et al., 2019; Watson, 2006; Zhang et al., 2020), despite the activities for the profession having been listed for so long (CFC, 1983). However, they also demonstrate that the more traditional and routine aspects of accounting conduct are still highly valued, lacking advances aimed at business management, which allows the profession to maintain its long-term sustainability.

Final Remarks

The results of this research indicate that the accounting profession in Brazil remains predominantly focused on traditional, tax, and reporting activities, although there is room for expansion into strategic and consultative functions. The PCA revealed the formation of five major groups of activities: reporting, strategic, structural, equity, and tax, which together reflect the breadth of the accountant’s role and the balance between routine tasks and those that support management and decision-making.

The first component comprises reporting activities grouped into actions, which demonstrate the results of regular activities and serve as decision-making support for accounting users. In this sense, the professional-managerial profile of accounting would support the decision-making process that requires organisational transparency for the performance of its activities.

The second component for the sustainability of accounting is strategic activities, which encompass those necessary due to changes in the professional environment that is institutionalised over time. In other words, they are strategic activities that require the accounting professional to possess the competence to support problem-solving, provide information in decision-making, act as a business partner, and develop more generic skills in leadership, communication, critical thinking, and problem-solving.

The third component, structural activities, encompasses information on accounting demonstrations, reconciliations, insolvency analysis, material and internal control, and account planning, all of which underpin operational excellence. These pre- and during-routine actions ensure financial integrity and strategic goal attainment.

The fourth component is equity activities, encompassing bookkeeping, reconciliation, calculations, and financial reporting. These activities ensure adequate depiction of an organisation’s financial health and equity position, providing a clear picture of its net worth.

The fifth component encompasses organisational tax activities, ranging from routine compliance to the preparation of complex foreign currency financial statements. This ensures adherence to tax regulations and global financial reporting.

The formation of the five composite components suggests that users attribute different degrees of importance to accounting activities. This perception is related to the potential impact of these activities on the organisation’s management and the constant environmental changes these professionals face. Therefore, despite the activities listed for a long time, the accounting profession’s conduct ensures the work remains valued and continues in the future. The professional profile has been adjusted to meet the needs arising from the changes in the society in which the organisations are embedded. The results also demonstrate that priority stakeholders are in tune with the professional needs arising from the cultural environment and the constant institutional changes. Complementarily, they demonstrate that traditional and routine accounting practices are still highly valued, despite the lack of advances in business management as recommended by the reviewed literature, which allows the profession to be appreciated for its long-term sustainability.

Stakeholders are seen to prioritise activities directly related to meeting legal requirements and preparing financial statements, confirming the role of accounting as an instrument of compliance and accountability. At the same time, the lower valuation of activities such as translation of financial statements into foreign currency, materials control, and flowchart preparation suggests that the current context of practice is still concentrated in small and medium-sized enterprises, with less integration into international markets and lower demand for advanced management tools.

From an institutional standpoint, the findings reinforce that the evolution of the institutional matrix is gradual yet essential for strengthening the profession. The growing appreciation of strategic and decision-support activities is expected as organisations face increasingly complex environments, requiring accounting professionals to develop analytical, communication, and leadership skills. This points to the need for alignment among academic training, regulatory bodies, and the labour market, to prepare accountants for a more consultative and business-partner role.

Thus, it can be concluded that, although traditional practices remain relevant and necessary, the long-term sustainability of the profession depends on its ability to adapt to institutional, cultural, and technological transformations, taking on a more strategic role within organisations. Strengthening this vision may contribute to the country’s institutional development, attract higher-quality investments, and enhance the contribution of accounting to business competitiveness and society.

Finally, it is noteworthy that the study had limitations that may support future research. Initially, it began with activities officially listed by the professional regulatory body, without consulting accounting professionals about their execution, and incorporated other activities through institutionalised practices. We also did not consult with accounting stakeholders other than accountants and selected users, who may have had different perceptions. Regarding methodological limitations, although the sample is significant, it was collected for convenience. Therefore, we cannot interpret the results by company size, the sector in which they operate, or the respondents’ group. In addition, we used PCA as a technique. However, other studies can confirm the composite components using structural equation modelling. Additional studies can corroborate the perceptions of users and accounting professionals through other qualitative techniques, enriching the initial insights presented in this study.

References

Abdi, H. (2003). Factor rotations in factor analyses. In A. Bryman, M. Lewis-Beck, & T. Futing Liao, Encyclopedia of social sciences research methods (pp. 1-8). Sage.

Al-Htaybat, K., Alberti-Alhtaybat, L., & Alhatabat, Z. (2018). Educating digital natives for the future: accounting educators’ evaluation of the accounting curriculum. Accounting Education, 27(4), 333-357. https://doi.org/10.1080/09639284.2018.1437758

American Institute of Certified Public Accountants (AICPA). (2011). CPA horizons 2025 report. Author. http://www.aicpa.org/Research/CPAHorizons2025/DownloadableDocuments/cpa-horizons-report-web.pdf

Annisette, M., & Trivedi, V. U. (2013). Globalization, paradox and the (un)making of identities: Immigrant Chartered Accountants of India in Canada. Accounting, Organizations and Society, 38(1), 1-29. https://doi.org/10.1016/j.aos.2012.08.004

Barth, M. E. (2018). Accounting in 2036: A Learned Profession: Part I: The Role of Research. The Accounting Review, 93(6), 383-385. https://doi.org/10.2308/accr-10627

Berry, R., & Routon, W. (2020). Soft skill change perceptions of accounting majors: Current practitioner views versus their own reality. Journal of Accounting Education, 53, 1-12. https://doi.org/10.1016/j.jaccedu.2020.100691

Bowles, M., Ghosh, S., & Thomas, L. (2020). Future-proofing accounting professionals: Ensuring graduate employability and future readiness. The Journal of Teaching and Learning for Graduate Employability, 11(1), 1-21. https://doi.org/10.21153/jtlge2020vol11no1art886

Box, G. E. P. (1953). Non-normality and tests on variances. Biometrika, 40(3-4), 318-335. https://doi.org/10.2307/2333350

Brazil. (1946, May 27). Decreto-Lei nº 9.295. Cria o Conselho Federal de Contabilidade, define as atribuições do Contador e dá outras providências. http://www.portaldecontabilidade.com.br/legislacao/decretolei9295.htm

Brennan, N., & Kirwan, C. (2015). Audit committees: practices, practitioners, and praxis of governance. Accounting, Auditing & Accountability Journal, 28(4), 466-493. https://doi.org/10.1108/AAAJ-01-2015-1925

Brouard, F., Bujaki, M., Durocher, S., & Neilson, L. (2017). Professional Accountants’ Identity Formation: An Integrative Framework. Journal of Business Ethics, 142, 225-238. https://doi.org/10.1007/s10551-016-3157-z

Caglio, A., Cameran, M., & Klobas, J. (2019). What is an Accountant? An Investigation of Images. European Accounting Review, 28(5), 849-871. https://doi.org/10.1080/09638180.2018.1550000

Chartered Accountants (CA ANZ). (2017). The future of talent. Opportunities unlimited. CA ANZ and PwC. Chartered Accountants. https://www.charteredaccountantsanz.com/news-and-analysis/insights/research-and-insights/the-future-of-talent

Churchill, G. A. (1979). A paradigm for developing better measures of marketing constructs. Journal of Marketing Research, 16, 64-73. https://doi.org/10.2307/3150876

Conselho Federal de Contabilidade (CFC). (1983). Resolução nº 560. Regulamentação da profissão de contador. Author. http://www.portaldecontabilidade.com.br/legislacao/resolucaocfc560.htm

Cortina, J. M. (1993). What is coefficient Alpha? An examination of theory and applications. Journal of Applied Psychology, 78(1), 98-104. https://doi.org/10.1037/0021-9010.78.1.98

Cronbach, L. J. (1951). Coefficient alpha and the internal structure of tests. Psychometrika, 16(3), 297-334. https://doi.org/10.1007/BF02310555

DiMaggio, P. J., & Powell, W. W. (1991). The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. In The New Institutionalism in Organizational Analysis (pp. 63-82). University of Chicago Press.

Doan, D., Nguyen, L., & Thanh, H. (2020). Factors affecting the application of IFRS through the perceptions of business managers and auditors in Vietnam. Problems and Perspectives in Management, 18(1), 371-384. https://doi.org/10.21511/ppm.18(1).2020.32

Durocher, S., Fortin, A., & Côté, L. (2007). User’s participation in the accounting standard-setting process: A theory-building study. Accounting, Organizations and Society, 32, 29-59. https://doi.org/10.1016/j.aos.2006.03.004

Eddy, E. R., D’Abate, C. P., Tannenbaum, S. I., Givens-Skeaton, S., & Robinson, G. (2006). Key characteristics of effective and ineffective developmental interactions. Human Resource Development Quarterly, 17(1), 59-84. https://doi.org/10.1002/hrdq.1161

Figueiredo Filho, D., & Silva Junior, J. A. (2010). Visão além do alcance: uma introdução à análise fatorial. Opinião Pública, 16(1), 160-185. https://doi.org/10.1590/S0104-62762010000100007

Frii, P., & Hamberg, M. (2021). What motives shape the initial accounting for goodwill under IFRS 3 in a setting dominated by controlling owners? Accounting in Europe, 18(2), 218-248. https://doi.org/10.1080/17449480.2021.1912369

Gendron, Y., Suddaby, R., & Lam, H. (2006). An examination of the ethical commitment of professional accountants to auditor independence. Journal of Business Ethics, 64(2), 169-193. https://doi.org/10.1007/s10551-005-3095-7

Goretzki, L., Strauss, E., & Weber, J. (2013). An institutional perspective on the changes in management accountants’ professional role. Management Accounting Research, 24, 41-63. https://doi.org/10.1016/j.mar.2012.11.002

Granlund, M., & Lukka, K. (1998). Towards increasing business orientation: Finnish management accountants in a changing cultural context. Management Accounting Research, 9(2), 185-211. https://doi.org/10.1006/mare.1998.0076

Guerreiro, M. S., Rodrigues, L. L., & Craig, R. (2015). Institutional Change of Accounting Systems: The Adoption of a Regime of Adapted International Financial Reporting Standards, European Accounting Review, 24(2), 379-409. https://doi.org/10.1080/09638180.2014.887477

Hadid, W., & Al-Sayed, M. (2021). Management accountants and strategic management accounting: The role of organizational culture and information systems. Management Accounting Research, 50, 100725. https://doi.org/10.1016/j.mar.2020.100725

Hair, J. F., Black, W. C., Babin, B. J., Anderson, R. E., & Tathan, R. L. (2009). Análise multivariada de dados (6th ed.). Bookman.

Hamilton, S. E. (2013). Exploring professional identity: The perceptions of chartered accountant students. The British Accounting Review, 45(1), 37-49. https://doi.org/10.1016/j.bar.2012.12.002

Hanson, M. (2001). Institutional theory and educational change. Educational Administration Quarterly, 37(5), 637-661. https://doi.org/10.1177/00131610121969451

Hicks, E., Bagg, R., Doyle, W., & Young, J. (2007). Canadian accountants: Examining workplace learning. Journal of Workplace Learning, 19(2), 61-77. https://doi.org/10.1108/13665620710728457

Hiramatsu, K. (2018). Accounting in 2036: A Learned Profession: Part III: Accounting Education to Foster Learned Profession Globally. The Accounting Review, 93(6), 391-393. https://doi.org/10.2308/accr-10629

Howieson, B., Hancock, P., Segal, N., Kavanagh, M., Tempone, I., & Kent, J. (2014). Who should teach what? Australian perceptions of the roles of universities and practice in the education of professional accountants. Journal of Accounting Education, 32(3), 259-275. https://doi.org/10.1016/j.jaccedu.2014.05.001

Humphrey, C. (2005). In the aftermath of crisis: Reflections on the principles, values and significance of academic inquiry in accounting: Introduction. Accounting, Auditing & Accountability Journal, 14(2), 341-351. https://doi.org/10.1080/09638180500127585

Ishola, A., Adeleye, S., & Tanimola, F. (2018). Impact of Educational, Professional Qualification and Years of Experience on Accountants’ Job Performance. Journal of Accounting and Financial Management, 4(1), 32-44. https://doi.org/10.5281/zenodo.1210796

Järvinen, J. (2009). Shifting NPM agendas and management accountants’ occupational identities. Accounting, Auditing & Accountability Journal, 22(8), 1187-1210. https://doi.org/10.1108/09513570910999283

Kaiser, H. F. (1968). A measure of the average intercorrelation. Educational and Psychological Measurement, 28, 245-247. https://doi.org/10.1177/001316446802800203

Kaiser, H. F. (1974). An index of factorial simplicity. Psychometrika, 39(1), 31-36. https://doi.org/10.1007/BF02291575

Kaplan, R. S. (2011). Accounting scholarship that advances professional knowledge and practice. The Accounting Review, 86(2), 367-383. https://doi.org/10.2308/accr.00000031

Kim, J. O., & Mueller, C. W. (1978). Introduction to Factor Analysis. Sage Publications. https://doi.org/10.4135/9781412984652

Kristanto, A. B., & Cao, J. (2024). The landscape of accounting-related research in Indonesia: mapping distinctive settings and future research agenda. Journal of Accounting Literature. https://doi.org/10.2139/ssrn.4769431

Kuhlman, E. (2013). Sociology of professions: Towards international context-sensitive approaches. South African Review of Sociology, 44(2), 7-17. https://doi.org/10.1080/21528586.2013.802534

Lantto, A. (2014). Business Involvement in Accounting: A Case Study of International Financial Reporting Standards Adoption and the Work of Accountants. European Accounting Review, 23(2), 335-356. https://doi.org/10.1080/09638180.2013.833411

Lattin, J., Carroll, J. D., & Green, P. E. (2011). Análise de dados multivariados. Cengage Learning.

Lawrence, T. B., & Shadnam, M. (2008). Institutional Theory. In W. Donsbach, The International Encyclopedia of Communication (1st ed.). John Wiley & Sons, Ltd. https://doi.org/10.1002/9781405186407.wbieci035

Lee, K., Carswell, J., & Alle, N. (2000). A Meta-Analytic Review of Occupational Commitment: Relations with Person- and Work-Related Variables. Journal of Applied Psychology, 85, 799-811. https://doi.org/10.1037/0021-9010.85.5.799

Loach, K., Rowley, J., & Griffiths, J. (2017). Cultural sustainability as a strategy for the survival of museums and libraries. International Journal of Cultural Policy, 23(2), 186-198. https://doi.org/10.1080/10286632.2016.1184657

Macagnan, C. B. (2013). Teoría institucional: escrito teórico sobre los protagonistas de la escuela institucionalista de economía. BASE - Revista de Administração e Contabilidade da Unisinos,10(2), 130-141. https://doi.org/10.4013/base.2013.102.03

Marsick, V. J., & Watkins, K. E. (2001). Informal and incidental learning. New Directions for Adult and Continuing Education, 89(Spring), 25-34. https://doi.org/10.1002/ace.5

Martendal, G., Hoffmann, G. B., & Martins, Z. B. (2020). A Evolução e Perspectivas da Profissão Contábil: Uma Percepção de Profissionais Contábeis. Ciência & Trópico, 44(2), 169-191. https://doi.org/10.33148/cetropicov44n2(2020)art6

Meyer, J. W., & Rowan, B. (1977). Institutionalized organizations: Formal structure as myth and ceremony. American Journal of Sociology, 83, 340-363. https://doi.org/10.1086/226550

Michelon, G., Trojanowski, G., & Sealy, R. (2021). Narrative Reporting: State of the Art and Future Challenges. Accounting in Europe, 19(1), 7-47. https://doi.org/10.1080/17449480.2021.1900582

North, D. C. (1990). Institutions, institutional change, and economic performance. Cambridge University Press. https://doi.org/10.1017/CBO9780511808678

Norusis, M. J. (1990). SPSS Base System User’s Guide. SPSS, Inc.

Nowotny, S., Hirsch, B., & Nitzl, C. (2022). The influence of organizational structure on value-based management sophistication. Management Accounting Research, 56, 1-13. https://doi.org/10.1016/j.mar.2022.100797

Oyewo, B. (2020). Outcomes of interaction between organizational characteristics and management accounting practice on corporate sustainability: the global management accounting principles (GMAP) approach. Journal of Sustainable Finance & Investment, 11(4), 351-385. https://doi.org/10.1080/20430795.2020.1738141

Oyewo, B., Ajibolade, S., & Obazee, A. (2019). The influence of stakeholders on management accounting practice. Journal of Sustainable Finance & Investment, 9(4), 295-324. https://doi.org/10.1080/20430795.2019.1619336

Payne, L., & O’Neil, J. K. (2019). Cultural Sustainability in Higher Education. In W. Leal Filho (Ed.), Encyclopedia of Sustainability in Higher Education (pp. 1-7). Springer. https://doi.org/10.1007/978-3-319-63951-2_109-1

Richardson, P., Dellaportas, S., Perera, L., & Richardson, B. (2015). Towards a conceptual framework on the categorization of stereotypical perceptions in accounting. Journal of Accounting Literature, 35, 28-46. https://doi.org/10.1016/j.acclit.2015.09.002

Rodrigues, M., & Picard, C. (2022). Non-accountants and Accounting: On the Emancipatory Mobilization of Accounting by Sustainability Managers. European Accounting Review, 32(5), 1217-1245. https://doi.org/10.1080/09638180.2022.2052921

Santos, B. L., Suave, R., Ferreira, M. M., & Altoé, S. M. L. (2019). Profissão contábil em tempos de mudança: implicações do avanço tecnológico nas atividades em um escritório de contabilidade. RC&C - Revista Contabilidade e Controladoria, 11(3), 113-133. https://doi.org/10.5380/rcc.v11i3.71765

Scott, W. R. (1991). Unpacking institutional arguments. In The New Institutionalism in Organizational Analysis (pp. 164-182). University of Chicago Press.

Seo, M. G., & Creed, W. D. (2002). Institutional contradictions, praxis, and institutional change: A dialectical perspective. Academy of Management Review, 27(2), 222-247. https://doi.org/10.2307/4134353

Seibert, R. & Macagnan, C. (2017). Responsabilidade social: A transparência das Instituições de Ensino Superior Filantrópicas. Mauritius. Novas Edições Acadêmicas.

Spanyi, A. (2006). It’s time to change: CFOs must move beyond their traditional financial scorekeeping role and also develop leadership skills in strategy and operations if they want to succeed today. Strategic Finance, 88(4), 31-35. https://link.gale.com/apps/doc/A152888884/AONE?u=anon~7a44e6b5&sid=googleScholar&xid=c44f70b0

Stevens, J. (1986). Applied Multivariate Statistics for the Social Sciences. Lawrence Erlbaum Associates.

Thomson, J. C. (2009). Closing the accounting talent gap. The CPA Journal, 79(12), 13-14. https://www.cpajournal.com/2017/10/06/accounting-profession-committed-closing-skills-gap/

Tongur, S., & Engwall, M. (2014). The business model dilemma of technology shifts. Technovation, 34, 525-535. https://doi.org/10.1016/j.technovation.2014.02.006

Watson, R. (2006). Is there a role for higher education in preparing nurses? Nurse Education Today, 26(8), 622-626. https://doi.org/10.1016/j.nedt.2006.07.008

Williams, B., Onsman, A., & Brown, T. (2010). Exploratory factor analysis: A five-step guide for novices. Journal of Emergency Primary Health Care, 8, 1-13. https://doi.org/10.33151/ajp.8.3.93

Zandi, G., Chuan, T. K., & Mansori, S. (2019). A study of accounting outsourcing decision: The case of Malaysian SMEs. International Journal of Financial Research, 10(5), 153-160. https://doi.org/10.5430/ijfr.v10n5p153

Zhang, Y., Xiong, F., Xie, Y., Fan, X., & Gu, H. (2020). The Impact of Artificial Intelligence and Blockchain on the Accounting Profession. IEEE Access, 8, 110461-110477. https://doi.org/10.1109/ACCESS.2020.3000505

Notes

*

Research article

Author notes

a Corresponding author. E-mail: caroline.orth@ufrgs.br

Additional information

How to cite: Macagnan, C. B., De Oliveira

Orth, C., & Seibert, R. M. (2025). Sustainability of Accounting Activities:

What Do Accounting Managers and Professionals Think? Cuadernos de Contabilidad, 26. https://doi.org/10.11144/Javeriana.cc26.acdp